Beaten Up: Douglass Elliman (DOUG) - 3x EBITDA, ex. Spin-Off

Not much needs to go right...

Douglass Elliman (DOUG) is a large residential real estate brokerage company, whose name is “synonymous with luxury”. Here is an overview of the company’s recent financial/valuation statistics:

As you can see the stock looks cheap… Well, since spinning off from Vector Group in late December of 2021, DOUG’s stock has been absolutely hammered. YTD the stock is down ~60%! Putting DOUG in the esteemed 60%+ price decline club, along with an esteemed list of VIPs including former idiotic investment darlings of the easy money era and cryptocurrencies:

(Tikr.com)

While the chart looks like that of a De-SPACed company, DOUG is a profitable and well-capitalized firm. Unfortunately for DOUG, its spin-off coincided almost perfectly (imperfectly?) with the ongoing market rout and recession. Naturally then, one would expect the stock to be down. Add in the fact that the public’s sentiment surrounding real estate markets is at a level not seen in quite some time – and the stock decline may not seem so surprising after all.

Sure, this explains some of the damage, but not all. DOUG has been punished far more than both the market and its peers:

(light blue = S&P500, Purple = VNQ (Vanguard’s Real Estate ETF)

(Yahoo Finance)

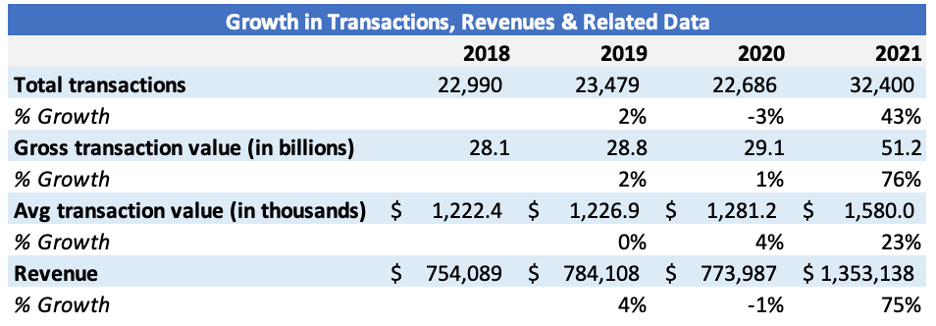

So, what explains the big decline? Certainly, some of it can be attributed to the aforementioned market decline, sentiment, etc. However, it is important to recognize that there are also valid reasons for concern. DOUG’s TTM/2021 earnings are inflated due to an unusually good housing market (refer to the graphic below):

This allowed DOUG to benefit from increased transactions and of course $ per transaction. With rates going up and a general decline in the economy, it is certain that 2022 results will look more like past years than 2021. But exactly what results will be, is anyone’s guess. At ~ 3.7x EBIT, one can infer what the market thinks. Still, I think it’s fascinating how much the stock has sold off, as it looks cheap even if you use analysts’ expectations of a 1/3rd cut to EBIT & 50% reduction in earnings - shown below:

Real estate is a cutthroat business, Enterprise Values are generally 7-12x EBITDA, as these companies operate with low margins - but 5x ‘22 EBIT (4x ’22 EBITDA) is far too cheap. How accurate are these analysts’ predictions? Hard to say, but 2022 1Q results have been released, and so far, they are tracking well (increases in revenue, decreases in margins).

As you can surely gather by my lack of predictive input – I do not know a whole lot about real estate markets, truthfully this is my first analysis of such a company. However, I really don’t think this investment idea is very complicated, nor predicated on 2022 predictions/in-depth industry analysis - see the market is pricing DOUG’s stock as if –

at best: earnings are going to get cut in half and stay depressed for some time at worst: for the USA to experience another housing Armageddon.

To put it simply, I don’t believe either of these things is likely to happen, and if I’m right this idea most likely works well. To be clear, I do think earnings could easily be cut in half, but DOUG will certainly recover and generate meaningful returns over 3-5 years. Furthermore, this fear is already priced in and so over the next couple of years, I suspect an investment at these levels will end up looking like a steal.

It can be fun to go against the crowd (assuming you’re right), and DOUG is probably one of the best ways to make a contrarian - to market sentiment - bet on real estate. In addition to its solid net cash position and > 4% dividend yield, DOUG is far more attractively positioned for a decline in the housing markets than most of its competitors. As I mentioned at the beginning, DOUG is a luxury realtor, their listings command far higher prices than other brokers:

Obviously higher inflation and mortgage rates will hurt all buyers/renters, but it is well known that – all things being equal – the wealthy are impacted far less than the middle & lower class. Remarkably despite this advantage, DOUG is undervalued compared to its peers/competitors on multiple valuation metrics, in many cases significantly:

Therefore this investment is not only a contrarian bet on ultra-pessimistic housing market expectations but also a bet on the market recognizing DOUG’s mispricing compared to its competitors.

How should DOUG be valued? When considering its less than stellar management team, I see no reason to assign them a high multiple for their industry. Real estate industry multiples are low compared to other sectors (7-13x EBITDA depending on where we are in the cycle). Therefore it should be reasonable to assign DOUG a conservative multiple around 7x EBITDA (8-9x EBIT). However, deciphering what future EBITDA or EBIT will be for DOUG is a far more challenging task. If you refer to our summary statistics, you may be forgiven for putting too much emphasis on the 2020 EBIT of -$46m, regarding your estimation of how much EBIT might revert to past results. This number included non-recurring items that need to be taken out. After adjustments/normalization, the progression of EBIT looks like this:

Still not great, but perhaps not as gloomy as you might have initially thought. One important thing to note about DOUG is that while under Vector, they were able to grow very fast, using corporate money from the parent company. While this of course helped them gain a larger footprint and grow, it had a negative impact on margins. As a stand-alone company, DOUG will focus more on profitability than scale, though they will have to better manage costs.

There is only so much improvement a company in this industry can make regarding margins but I don’t take any issue with the analyst target of 6% in 2023, and I am comfortable taking that out to 2025. In regard to revenue growth, I am taking analyst expectations out to 2023, then using a simple 5% growth rate. In my valuation I am also adding a 15% discount to take care of potential stock dilution, as management is a big fan of issuing/receiving SBC:

Suffice to say the potential here excites me and I think this is an interesting stock. DOUG could end up being a profitable trade for a gutsy investor with patience.

Thank you for reading! Feel free to reach out - and I appreciate any and all feedback.

Disclosure: None of this is investment advice, always conduct your own due diligence before making any investment and be aware of the risks that come with investing in small, less liquid companies.