DEEP Value: 1/3 Net Cash & Securities and Overblown Fears: Symbolic Logic: (EVOL)

A perfect storm creates a perfect opportunity

Well this sucks (as a writer not as a shareholder) - Today EVOL shares are up 27% to $1.43, after EVOL announced a $9.6m tender offer to purchase shares from $1.30-$1.55. I started writing this last week when shares were at $1.06, which was up from a low $0.84. During my research, writing, and revising, shares soon went up to around $1.12, but that didn’t materially change anything. Of course with today’s news and price action, this is a bit of an outdated writeup. But the stock is still cheap, and I need to move on to other companies. However I still think the stock cheap, and before diving into the analysis, here is an updated calculation of EVOL’s share price to its Net cash & securities based on today’s news:

One could argue the stock looks even cheaper now. Now onto the analysis…

SYMBOLIC LOGIC, INC. (EVOL)

According to Encyclopedia.com:

“Symbolic logic is the branch of mathematics that makes use of symbols to express logical ideas. This method makes it possible to manipulate ideas mathematically in much the same way that numbers are manipulated”

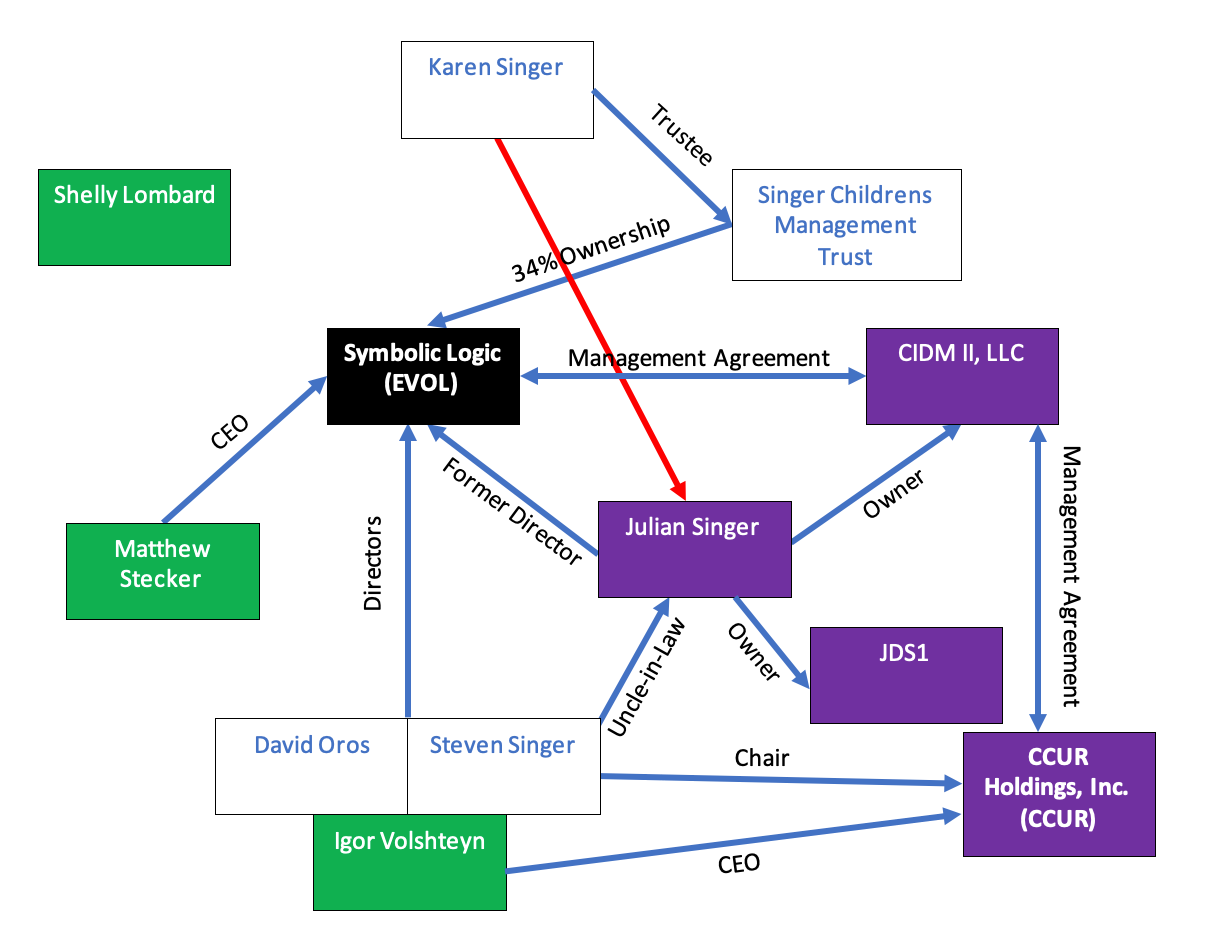

Ironically, even mathematical symbols fail to help simplify the complicated relationships and connections at Symbolic Logic, Inc. Perhaps schematics will do the trick.

INTRODUCTION

Since selling all its operations in October 2021, EVOL has amassed a collection of securities and cash, net of all liabilities of almost $3 per share, ($3.05 non-net). With shares selling at only $1.06, EVOL must be the cheapest non-expert market stock in the country. EVOL has no debt, no outstanding preferreds, and only one class of stock. They are not burning through cash, nor have they been issuing or granting bucket loads of stock/stock-based compensation. Since the beginning of 2022, there has even been a record amount of insider purchases. Why then, is this stock trading at 1/3 net cash & securities?

Well, to put it simply, EVOL was hit by a “perfect storm” of strange management actions, a de-listing, and plummeting investor sentiment…

PERFECT STORM

1 - STRANGE MANAGEMENT ACTIONS/DE-LISTING

Generally when a company divests all its operations, the proceeds are distributed to shareholders after the retirement of all debts and obligations. This kind of liquidation scenario can, of course, be very profitable for shareholders. EVOL’s asset sale was announced on October 18, 2021 and closed on December 31, 2021. In return for practically all their operating assets, EVOL received $40m, $37.5 of which was immediately received, with the remaining $2.5m put in escrow to be granted pending indemnification obligations. Shares immediately jumped following the announcement on the 18th, when CEO Matthew Stecker stated the following in EVOL’s press release:

“The Board of Directors has established an investment committee to evaluate options to maximize the value of the Company’s assets…or returning the cash to shareholders”

(Chart from Google Finance)

Mr. Stecker didn’t lie in his statement, but a careful reading of EVOL’s 8-k (filed on the same day) should have raised red flags and revealed the misleading nature of his comments:

“The Board formed a subcommittee (the “Investment Committee”) to evaluate options to maximize the value of the Company’s assets…The Board has authorized the Investment Committee to retain such counsel, experts, consultants, or other professionals as the Investment Committee shall deem appropriate…to aid the Investment Committee in the performance of its duties”

Hmm… No mention of returning cash as a possibility. Since then, EVOL’s stock has lost well over 50% of its value, as investors hoping for a liquidation have jumped ship en masse. To make matters worse, EVOL de-listed from the NASDAQ. Technically this was voluntarily, but given they had no more operations - only a portfolio of securities & cash, unless they were to register as an investment company, they were bound to be dropped. All the while, CEO Matthew Stecker received a $400k transaction bonus for the asset sale, despite not having any stock ownership.

To finalize the company’s transformation, EVOL announced it was changing its name from Evolving Systems (hence the ticker) to Symbolic Logic. As a result, EVOL is practically a shell company, but with a ton of cash. This is generally not the kind of operation that investors get excited about. Furthermore, in their most recent 10-q, EVOL gave one of the least reassuring/transparent descriptions of its busineess that I’ve ever seen a company make:

“The Company is currently a research and development organization with two initial areas of product focus, each of which are in a research-oriented pre-release mode. The two areas of focus are on the application of self-learning algorithms as well as the symbolic tagging and organizing of physical objects.”

At the very least, I guess the description explains the name change to “Symbolic”.

2 - POTENTIAL CONFLICTS OF INTEREST

If you refer back to the price chart, you will observe a couple of dates where EVOL’s stock price declined substantially. On one such date, January 21, 2022, EVOL entered into a management agreement with CIDM II LLC, to “assist the Investment Committee with their duties”. Per the terms of the agreement, EVOL will pay CIDM II a management fee of 2% of net asset value (NAV) and a performance fee of 20% of the appreciation of the end-of-year NAV. So, in other words, this is the equivalent of EVOL investing its cash into a hedge fund with the classic ‘2 & 20’ setup.

But here is where things get interesting…

#1: The payment to CIDM II will not be in cash, but in stock, which will of course dilute shareholders

#2: The manager of CIDM is Julian Singer, who only 11 days prior had resigned from EVOL’s Board of Directors, a position he had held since 2015. See the schematic Below:

(I will be building on this as the relationships get more complex)

3 - INVESTOR SENTIMENT

Of course, EVOL isn’t convered by analysts, but after some sleuthing on yahoo, twitter, etc, I discovered just how bad investor sentiment was. The biggest concern investors have, regarding EVOL, is the integrity (or lack thereof) of its management team and potential conflicts of interests. Some shareholders stated that various individuals involved with EVOL have a history of criminal & crooked behavior. Others claimed the CEO is weak, complicit, and a puppet. Well, now we have to explore the facts for our self. This section will take up the majority of the rest of the writeup, and it will surely read more like an investigation than a stock analysis.

THE FACTS ABOUT MANAGEMENT

Julian Singer isn’t the only director to have recently departed. On January 10, 2022, David Oros resigned from the position he had held since 2008. To replace Julian and David, EVOL’s Board appointed Steven Singer and Igor Volshteyn. According to the filings, Steven and Volshteyn are “independent” directors under the NASDAQ rules. Although no longer applicable after the delisting, there is nothing indipendent about anyone involved in this operation…

Before we analyze that, let’s explore the claims people are making of criminal history. According to an SEC filing, and NY Times article, Steven Singer and his brother Gary Singer were charged with some distasteful crimes relating to junk bond dealings in the 90’s. Apparently only Gary was found guilty, and as a result can no longer serve as an executive or director of publicly traded companies. For the record, it turns out that Gary is Julian’s father. The SEC named Gary, his wife Karen (who we will talk more about later), and Steven, among others, as defendents in the lawsuit (though Karen was not accused of any wrong doing). My experience of reading legal documents is non-existent, but it appears everyone agreed to some kind of settlement and that Steven agreed to a life-time ban from serving as an executive/etc, at investment advisory firms. Hence, why EVOL didn’t register and stay on the NASDAQ. Obviously this history is not something you want to see, but it is the only criminal activity I’ve found regarding the management team.

Now, back to the ‘independence’ of management. Steven Singer is Julian’s uncle and also the chairman of CCUR Holdings, where the previously mentioned Igor Volshteyn is CEO. CCUR Holdings is important as EVOL and CCUR have some common personnel, and CCUR has the exact same asset management agreement with CIDM II (Julian Singer), that EVOL has:

Currently CCUR is in a proxy fight with Catalyst Biosciences, Inc. (CBIO), to elect three of their own candidates to CBIO’s Board of Directors. Two of these candidates are familiar to us already, EVOL CEO Matthew Stecker, and the previously mentioned Igor Volshteyn. The other proposed candidate is named Shelly Lombard. Now, CCUR isn’t the only member of this proxy fight, they have teamed up with JDS1 LLC, CIDM II, Julian Singer, and David Oros. We know Singer runs CIDM II, but filings also reveal he is in control of JDS1. For simplicity’s sake then it is Julian, CCUR, and David Oros leading the proxy. David Oros is familiar to us as he is one of the EVOL directors that recently resigned:

(Purple = Proxy Members, Green = Proposed by Proxy Members for CBIO’s Board of Directors)

Remember at the beginning when I mentioned that there has been a record amount of insider purchases of EVOL’s stock? Well, the acquirer of all this stock is Singer Childrens Management Trust. The trustee of this trust is Karen Singer (Gary’s wife & Julian’s Mother). The trust is now the largest shareholder of EVOL stock:

(Red Arrow = Mother)

It is very important to recognize that since this is a trust, Karen, in her filings, has declaimed beneficial ownership for these shares. An FCC Record book from 2010, lists the Trust’s beneficiaries as being Taryn Singer, Julian Singer, and Devon Singer. Presumably, Devon & Taryn are Karen’s other two children. Some people might conclude that it is actually Julian or Gary calling the shots/telling Karen what to invest in. That would be very sneaky, but I am not so sure this is the case, nor have I found any evidence for this. In addition to the trust, Karen is also the sole managing member/holds all the voting power for TAR Holdings, LLC, through which she has participated in proxy contests, even writing letters to fellow shareholders. Again you could argue that these are actually written by someone else, but there is no proof for this, and everything I have found indicates that Karen is heavily involved. In fact SEC filings state that many members of the EVOL/CCUR/etc management teams who serve on other boards, got their positions at the recommendation of Karen. Though it is not clear if she personally recommended these people to the boards themselves, or just nominated them in a proxy contest. On a related note, I should mention that Shelly Lombard is a consultant for TAR, recall that Shelly was the third person Singer’s group nominated for CBIO’s board:

The biggest reason this piece took so long is becuase there are literally dozens & dozens of companies/organizations that these characters are involved in. Most of them overlap, and many have business interests in each other. Despite spending many hours researching and mapping out these connections, I cannot find any evidence of illegal activity, nor is much of it beyond what I have presented really that interesting or relevant. As a result, we will move on from the schematic section here, as things would get way too complicated.

Back to EVOL… The Trust made some significant purchases as the price of EVOL’s stock collapsed this year, see the table below:

(From Karen’s From 4s)

As of the last 10-q, EVOL has 12.3m shares outstanding. In other words, the Trust owns around 33% of EVOL, as you can see in the previous schematic. Regardless of whether Julian, Karen, Gart, or another family member, is calling the shots, this is a particularly fascinating situation. I cannot think of a reason why the Singer’s would buy so much stock and why Julian would sign an agreement to be paid in stock unless they thought the shares were significantly undervalued.

My biggest concern when I came across this company, was that management would take the cash themselves, through compensation, etc. Discovering the asset management agreement, who the manager was and his connections with the board/executives, only exacerbated these fears. But as we know, Julian is not taking cash compensation, he is getting paid in stock. That is still a very real expense for the company and its shareholders, but it seems like an innificent way for management to enrich itself. That combined with the huge buying spree, puzzles me greatly, as the dilution to shareholders will hurt Julian and co. the most. Perhaps they are trying to become majority shareholders, before taking the company “dark” and dissecting the assets however they see fit. Even so, I fail to see how this or any other option the Singers & co. could take, would maximize the value of their shares more than if EVOL had just distributed the cash and liquidated.

The only answer is that Julian and the Singer’s believe they can invest/use the cash to increase intrinsic value successfully. Fortunately for us, Julian and co. have a lot of experience that we can use to gauge their skill.

EXPERIENCES

There are several companies the Singer’s and co. have been a part of over the years. Most pertinent to EVOL, are situations where they are majority shareholders and fill the management team. The most obvious example is of course CCUR, where Volshteyn is the CEO. Another big example is Live Microsystems (LMSC). Both of these stocks are “dark-stocks”, meaning they are non-reporting and trade on the expert market. As such, using a price chart to analyze their performance is perhaps not very accurate, and there are no up to date financial statements (at least for non-shareholders). Both companies appear to have completed multiple reverse splits. This is a tactic that is unfortunately often used by crooked management teams to liquidate smaller shareholders for a price that is usually far below intrinsic value. CCUR & LMSC are also similar to EVOL in that they have sold off many/all of their operating assets. LMSC sold off the remainder of its assets in 2013, when Matthew Stecker was the CEO, and CCUR most recently sold off one of their fully-owned subsidiaries last year. Unfortunately, neither company has been a great long term investment for shareholders, more accurately they have been dreadful performers. However money was made by deep value folks who bought shares at valuations similar to the one’s EVOL trades at now.

While these two companies are the most relevant regarding EVOL, it is true that the team has made a number of good investments as well. For example, shoutout to @Graham_Disciple on Twitter, who let me know about Julian’s involvement in CSS Industries, and Support.com, which he mentioned have both been successful investments. In addition to those, various members of the management team were involved in Spartacus Acquisition Group, a SPAC sponsor, that completed a business combination and now trades as NextNav (NN). Though NN has naturally done dreadfully, the investment in the sponsor surely reaped rewards.

There are other examples out there, but considering the investments where the team has majority control, it is accurate to conclude they aren’t the most shareholder friendly. But the point I am making in this write-up is that, at 1/3 net cash, fears about management are far overblown, and not supported by the research I conducted. It is almost certain that the management team will look to take this company private, or atleast continue purchasing enough shares to be big-time majority owners. Hopefully this is done through repurchases, open-market transactions, etc. And not just stock compensation or reverse-splits. Additionaly, EVOL should end up on the expert market in the next year or so, just like CCUR, and LMSC.

To conclude, at 1/3 NC&S I view EVOL as one of the most obvious trades out there, even after considering management/related concerns. In a weird way, EVOL is basically a special situation investment. Though it will be a dog in the long run, folks who buy at these levels have huge upside, and little to zero downside.

As always thank you for reading, all feedback is appreciated. None of this is investment advice, and you should always do your own due diligence before making an investment. Disclosure: I own shares of EVOL stock.