Free Cash Flow Machine- Donnelley Financial Solutions, Inc. (DFIN)

Interesting Case - Slow/Little - No growth but Lots of FCF generation

(Almost all graphics are from two of DFIN’s investor presentations)

Background & Statistics

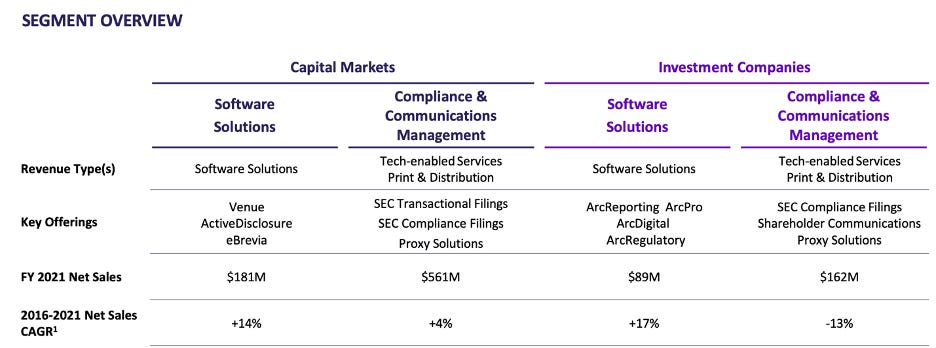

Donnelley Financial Solutions, Inc. (DFIN) is a very fascinating company and operates in one of the most interesting niches I’ve come across. DFIN provides regulatory filings and deal solutions to two business units: public/private companies (Capital Markets), and mutual funds/other regulated investment firms (Investment Companies). For both their Capital Markets and Investment Companies clients, DFIN offers two segments, Software Solutions (SS), and Compliance & Communications Management (CCM).

To put this simply, DFIN assists clients in remaining/becoming compliant with SEC regulations through their filings - whether that be basic recurring filings (10Q, 10K, 8K, etc.) or M&A-related.

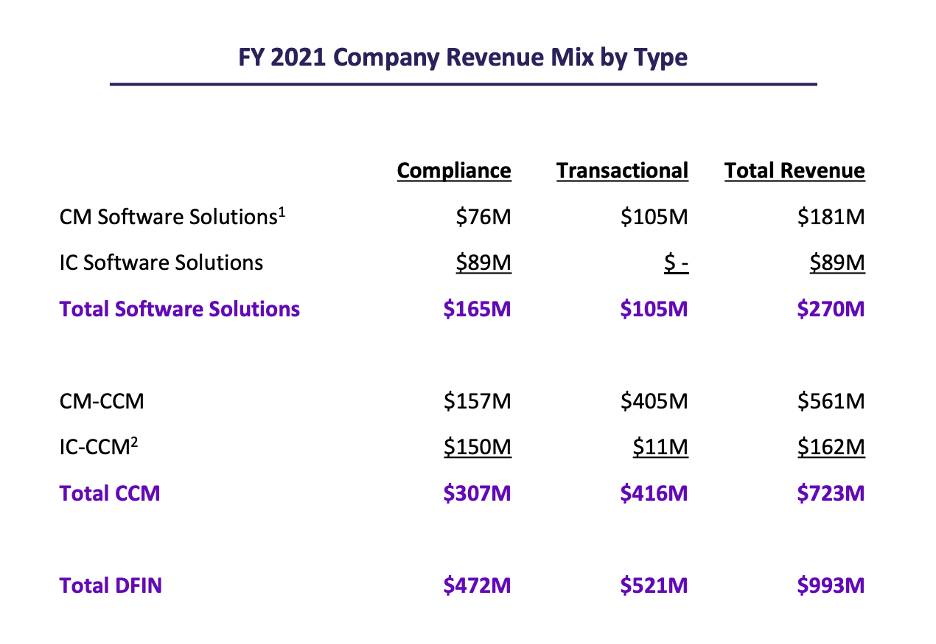

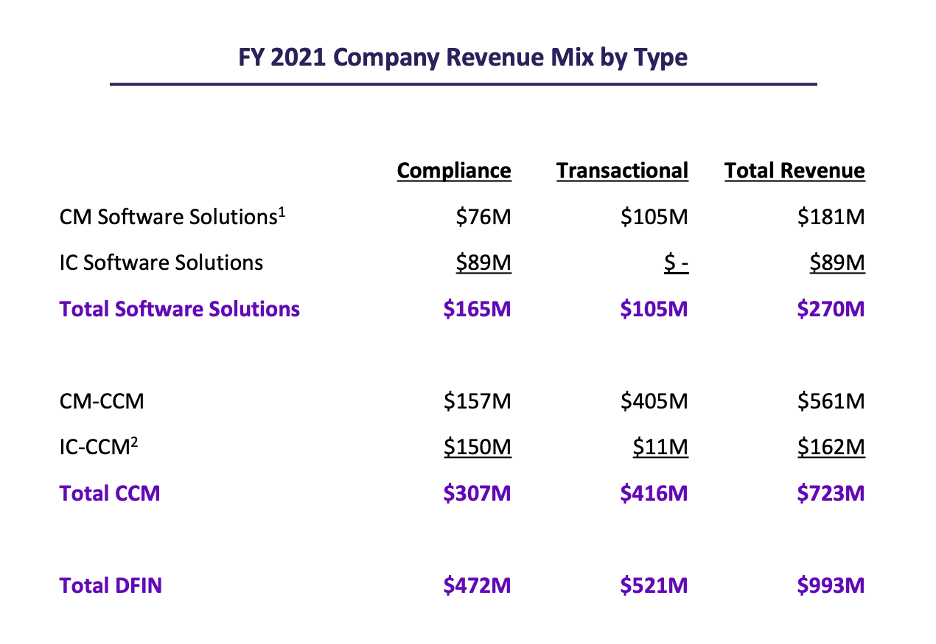

It makes sense then that DFIN separates its revenues into “transactional” and “compliance” sales. Transactional revenues are exactly what they sound like, sales generated from transactional activity. I’m just going to assume compliance sales need no explanation. Transactional sales are less predictable than compliance sales, but they are very profitable:

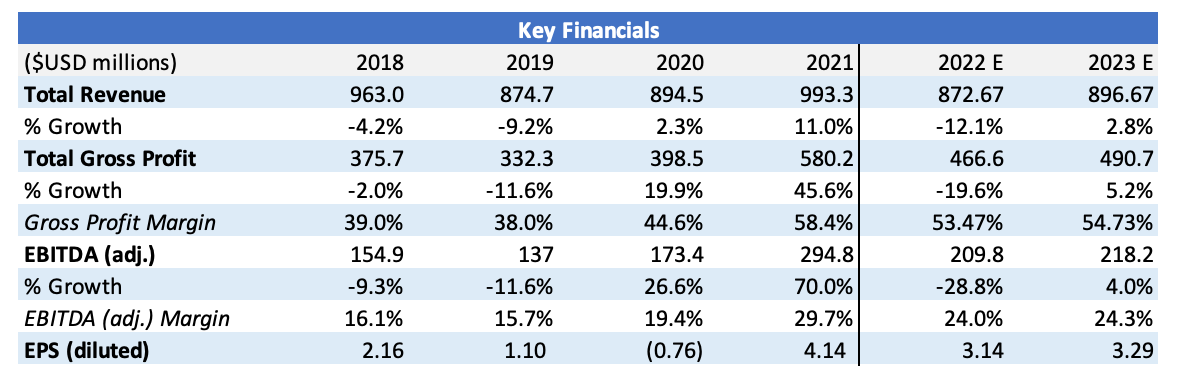

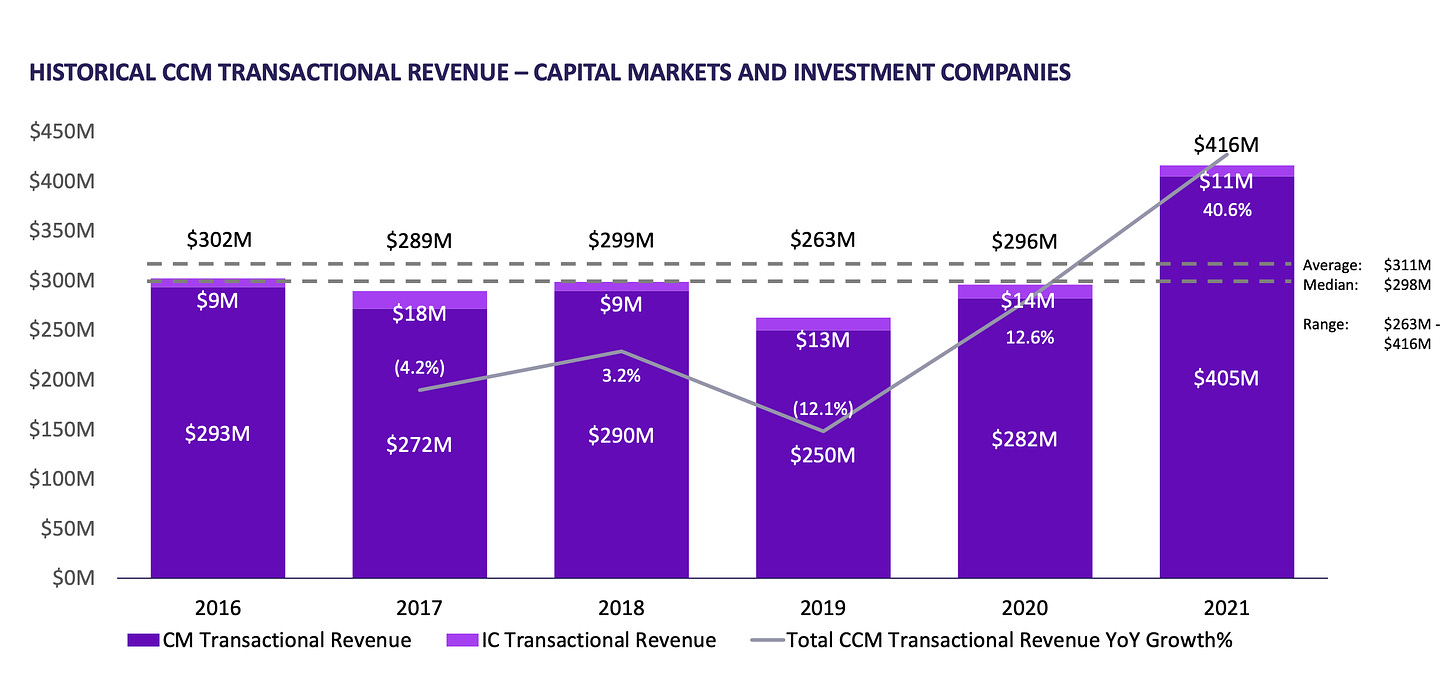

Because DFIN generates over 50% of its revenues from transactional sales, its top and bottom-line numbers are naturally highly predicated on good economic conditions, periods when transaction-related activities such as SPAC/de-SPACs, IPOs, etc, tend to grow. See the summary statistics below for a good visual example of this:

As a result, the general opinion of markets is that DFIN’s 2021 numbers are extraordinary/an outlier and not representative of what the company will earn in the future. This combined with the recent market crash and the generally negative sentiment regarding the economy’s short-term future has hurt DFIN’s stock price substantially:

Combine this with slow historic revenue growth - DFIN has grown sales from $983.5m in 2016 to… $993.3 in 2021, an increase of 1% over five years and a CAGR of 0.2% - and you have a recipe for a lowly valued company. Or in DFIN’s case - a company valued at an EV/EBITDA of 4.

Variance Perspective

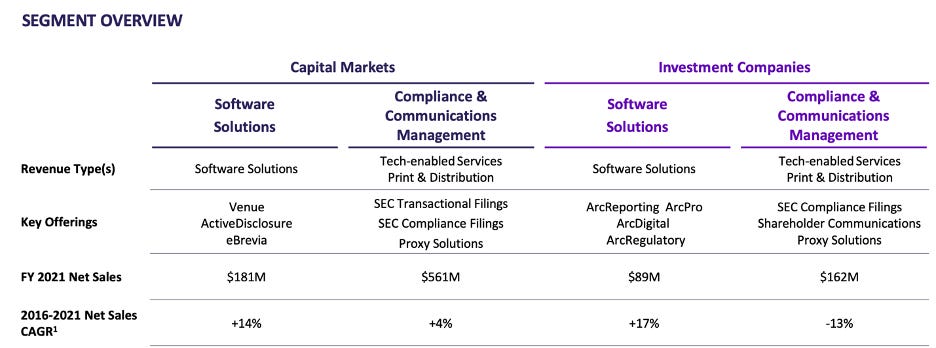

Yes, it is true that revenue growth has been abysmal, however, there is more to DFIN than what meets the eye… Let’s refer back to the segment graphic from before (posted below for convenience): Pay close attention to the last row

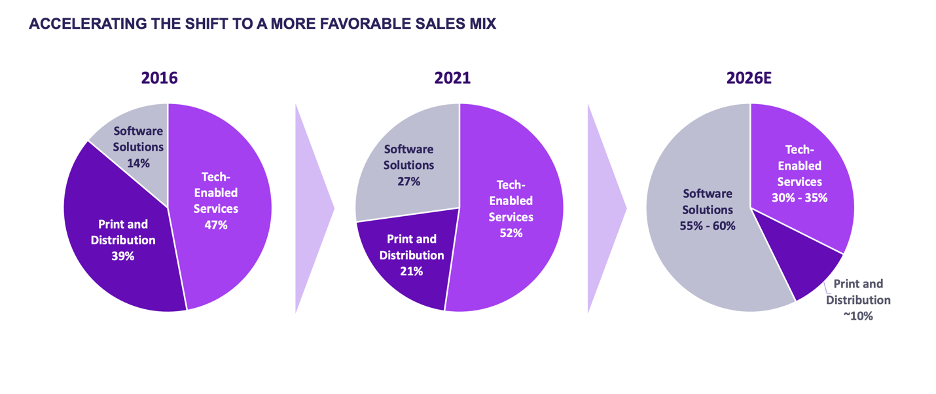

As you can observe, the smaller, software solutions segments are growing much faster than the larger CCM segment, made up of print & distribution and tech-enabled services. This is intentional and helps explains why the revenue growth (or lack there-of). You see, DFIN’s sales mix when it spun off in 2016, was almost majority print and distribution, as opposed to software solutions and tech-enabled services. Remember it wasn’t that long ago that most people received their annual/quarterly reports in the mail. However, DFIN’s team had the foresight, and they understood that the print services were losing market share, and additionally ran on low margins. Since the spin-off, management has made shifting to higher-margin software and technology products, a key part of the business plan. Management wasn’t just all talk either, the graphics below shows the impressive progress DFIN has made in this regard, as well as their goals for the future (more on this later):

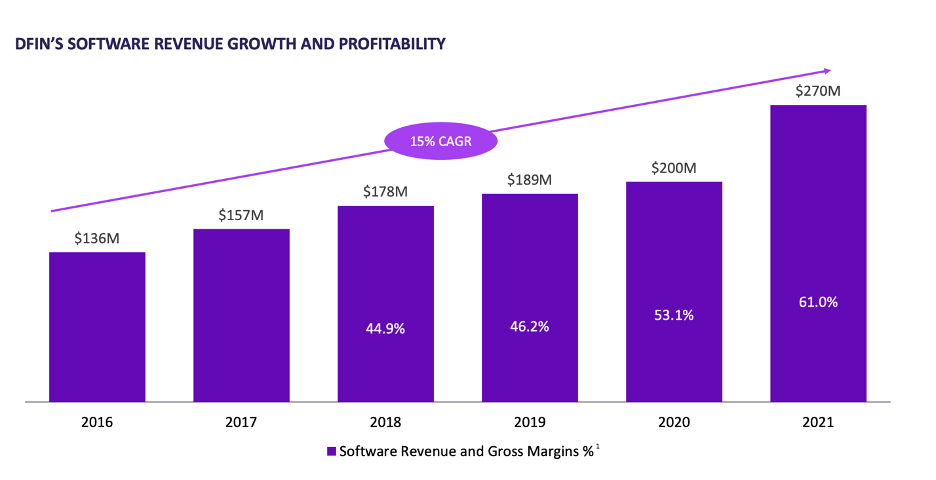

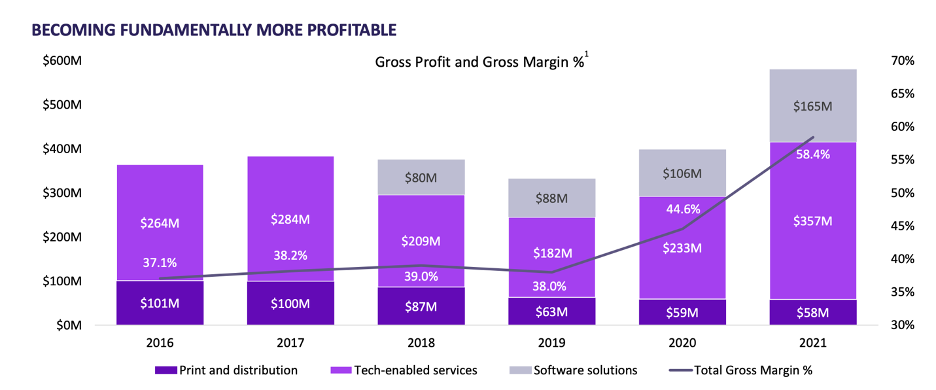

15% Software sales growth is no joke, especially at those margins. The increase in high-margin software sales has finally started to impact the broader revenue margins:

Eventually, as software and tech segment revenues continue to grow, DFIN will begin to increase total revenues at more substantial levels. Still, for the time being, their investments in software and tech have provided the company with operating leverage. The Print & Distribution segment was high in variable costs – by continuing to decrease its importance, and focus more on software & tech, DFIN will only need marginal increases in revenue to boost bottom-line numbers.

Software sales are also important because they are mostly comprised of compliance sales (reposted graphic for convenience):

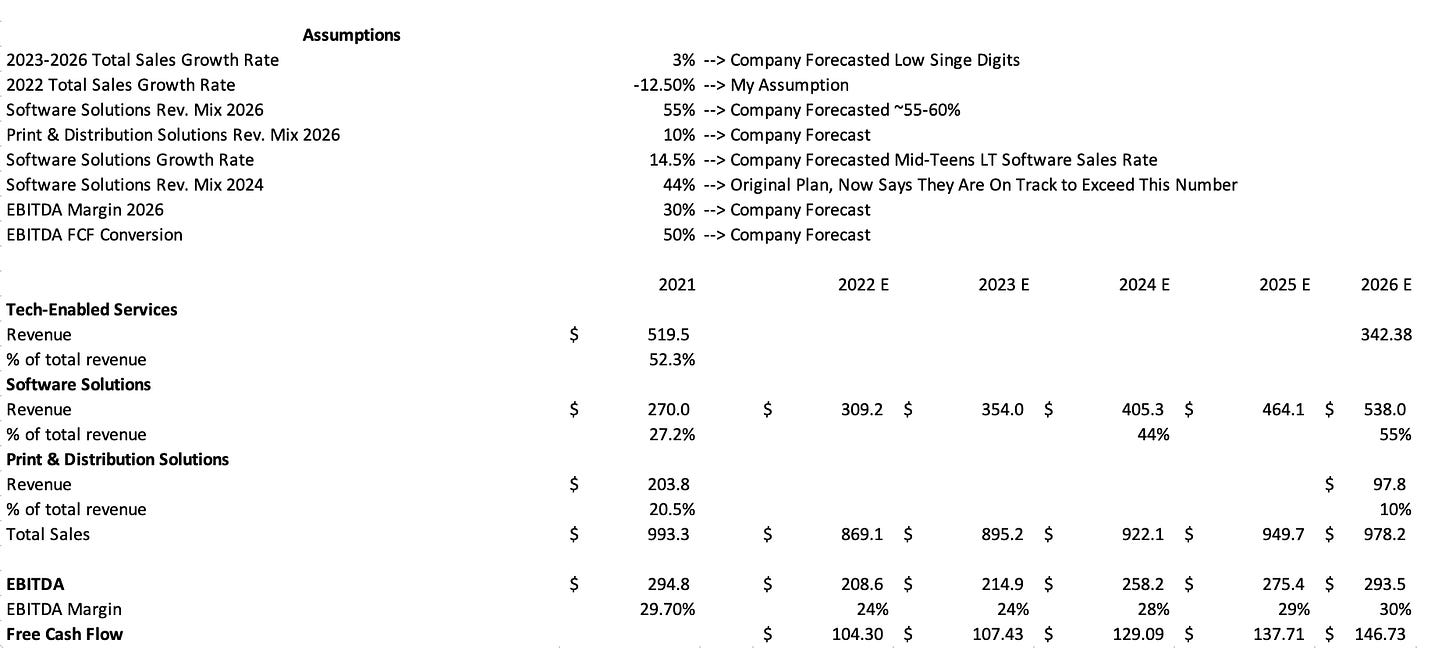

DFIN specifically wants to increase its compliance sales to > 70% of the total software solutions by 2026 (currently ~63%). This is important because these recurrent revenues will help offset the unpredictable but almost certain dips in transactional revenues. Considering DFIN estimates that Software sales will be > $500m by 2026 (14% CAGR, $270m currently) and represent 55% - 60% of DFIN’s 2026 sales mix (currently 27%), recurrent compliance sales should start to have a huge impact soon.

Clearly, DFIN benefitted substantially in 2021 from an extraordinarily strong market environment, with SPACs, IPOs, and M&A activity at or near all-time highs respectively. This obviously led to unsustainably high transactional revenues. However, I think it’s equally important to recognize the difficult market environment that they experienced in 2020, with COVID and subsequent issues:

In the future, as we mentioned, software sales become a bigger piece of the pie, we should see DFIN’s revenues start to steady out a little bit more. Modeling the future for DFIN is particularly hard, the company is conservative in guidance and only releases it one quarter out.

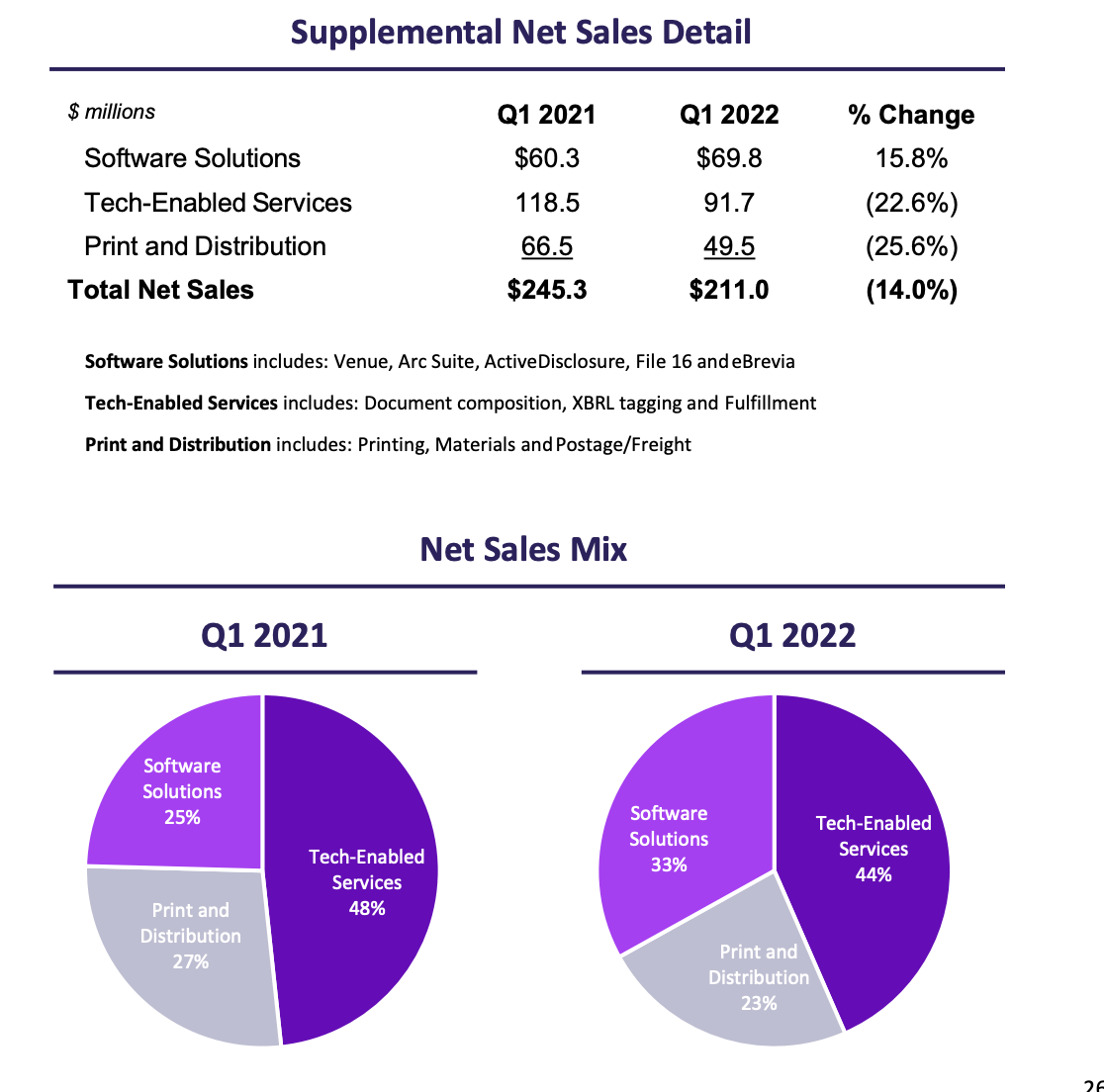

Because of SEC rules 30e-3 & 498A, which provide investment companies and annuity providers with an option to electronically deliver reports and other materials, the company forecasted $40m reductions in 2022 sales. (Actual sales reduction of $100m in 2021). First-quarter results have already been released, and so far everything is going as planned:

This year will definitely be a softer one for DFIN, considering the sec rule impacts, and a worsening economic environment, I conservatively estimate 2022 sales at around $870m. Here are the rest of my predictions, most assumptions are taken straight from management’s mouth.

A company that can consistently generate yearly free cash flow of $100m at high margins, deserves an EV/EBIT multiple higher than 4 wouldn’t you say?

Even if my predictions prove to be lousy, I believe there is some margin of safety offered by the ridiculously low starting valuation. It shouldn’t take much to beat the expectations of the market.

Catalyst

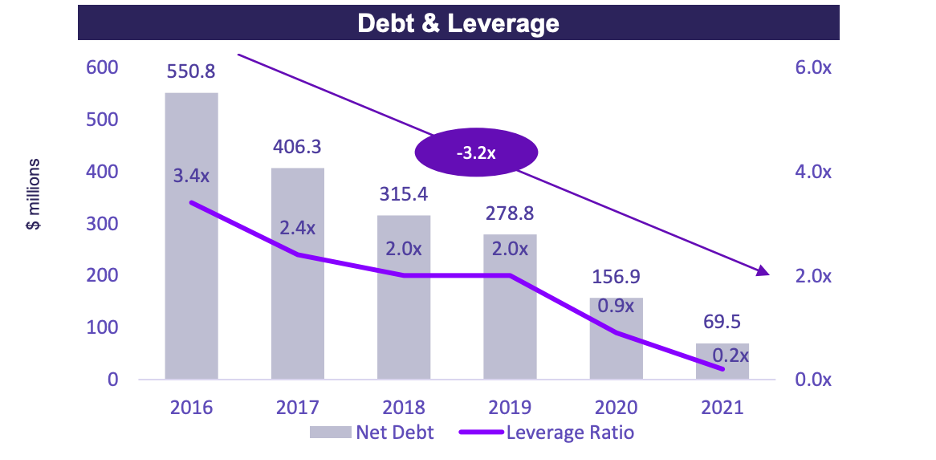

While this stock doesn’t really have a true catalyst, I think it is worthwhile to mention how they have used free cash flow in the past, and how they might utilize it in the future (potentially opening up a catalyst). DFIN has done a tremendous job of paying down debt, they are in a far different place now than they were only a couple of years ago:

They are expecting to reach net cash in 2023, and this includes assumptions for the complete fulfillment of their new $150m share repurchase program that they recently started, which expires at the end of 2023. They’ve already purchased over $40m of stock. in the last two years, so this could be an area they put a lot of work into. Lastly, management might go after some small acquisitions that create synergies, they’ve done pretty well with their acquisitions thus far, and this could be a good way to help the company grow.

Needless. to say, if the company performs anything close to what it has guided, it will have a lot of free cash flow on its hands, to create shareholder value. At current valuations, this seems like an attractive investment. In some ways DFIN is like a cigarette company, they won’t grow much, but you can count on lots of free cash flow generation…

Disclosure: As always, none of this is investment advice, you should always conduct your own due diligence before investing in any security.