Near "net-net" with a Hidden Catalyst - Allied Resources, Inc. (ALOD)

Way off the beaten path... asymmetric returns potential

Background/Summary

Incorporated in 2002, Allied Resources, Inc. (ALOD) is an independent O&G producer with interests in 145 wells in West Virginia and 9 wells in Texas. Allied’s interests in WV are through several leases operated by an independent operator, and its interests in TX are through three leases operated by independent third parties. Combined, these wells sit on developed acreage spread over ~5870 acres.

Allied has 5.65m shares outstanding, and shares are currently listed at $0.27 on the pink sheets (Mkt. Cap: ~$1.5m). With no debt and a collection of cash & liquid investments totaling $1.73m, Allied Resources has a negative enterprise value. Furthermore, Allied is almost a “net-net” with Net Current Assets at ~$1.42m, and shares trade at a substantial discount to book value. Given the illiquidity and spread, it is possible for a patient investor to grab shares under NCAV.

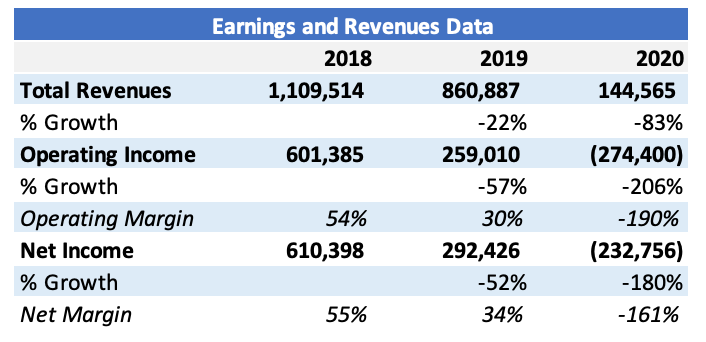

Allied doesn’t show up on investment screens, has no functioning website, and shares haven’t traded since June 23rd - it’s an “odd-ball” stock, in every sense of the word. Combine this with the fact that Allied hasn’t recorded a GAAP profit since 2019 - with revenues falling off a cliff due to crashing commodity prices during the height of the pandemic – and its stock price relative to tangible assets starts to make more sense:

Or does it?...

Variant Perspective & Catalyst

Energy prices have skyrocketed in the past year, and Allied’s revenues are slowly starting to reflect this improved environment. Revenues in 2021 were ~$312k, an increase of over 100% from 2020. Still operating and bottom-line numbers were in the red – however, 1Q results for FY 2022 were recently released, and the results are extremely promising: Revenues totaled $112k (vs. only $41k 1Q 2021), but more importantly margins on production have finally turned positive:

To be clear, 33% margins on production are not sustainable, as expenses will increase in the following quarters – but 6-10% should be more than achievable.

Why do I specify O&G Revenues, as opposed to total revenues? Well, this brings me to my next point, (and Catalyst) – Royalty revenues.

Allied has historically generated revenues from two sources, first from generic O&G producing operations, and second from royalties and lease bonus payments that exploration companies pay Allied in return for partial assignments of their leases. This segment is incredibly profitable, as Allied sits back and receives royalties. However, when energy prices decline substantially, exploration & development companies have no incentive to enter these deals or further develop for resources when already in a deal. This is precisely what happened during COVID-19, as royalty revenues dropped from $793k & $608k in 2018 & 2019 to zero in the years since. For a startling visual of how impactful this segment is, particularly on margins, refer to the two graphics below:

Now that energy prices are high and unlikely to come down anytime soon, the re-emergence of this royalty revenue segment could be a huge catalyst for earnings. Allied still has its 10-year partial assignment deals with third-party exploration companies on their WV interests (signed in 2019/2020) and it seems likely that development will commence in the near-term future – This belief is not based on simple guesswork, but on the company’s own comments:

“Allied also believes that results will improve in the longer term with the realization of additional revenue in the form of royalties from third-party development of the Marcellus formation that lies within the bounds of partial assignments of our West Virginia leasehold interests.”

(2021 Annual Report)

We already mentioned that Allied generated ~$600-800k of royalty revenues in the past - given that these results occurred when energy prices were lower than today, it’s reasonable to assume they could expect the high end of this amount ($800k), if not more, in a 12-month period moving forward. Based on the 1st quarter results, and management’s commentary in its filings, Allied should easily generate an additional $400k of production revenue over the next four quarters (about TTM totals). As you can see in the graphic below, oil production was low even in the 1Q of 2022 – furthermore in the filings, Allied mentioned that production is likely to increase in the future from these levels, thus I think our assumption is conservative and reasonable.

Combine this with the royalty revenues of $800k, and Allied has a clear path to ~$1.2m in revenues over the next twelve months. The margins on the production revenue are difficult to predict, but a conservative estimate assumes they can do 5%, below what they achieved in 2018. SG&A is simpler to model - Allied pays $12k per year for an office lease, and a $120k consulting fee (both to their CEO which is unfortunate and a red flag). Add in some allowances for other items and you get SG&A of around $162k – in line with historical results. Lastly, regarding operating expenses - depreciation and depletion tend to hover around $40k, offsetting this is interest income which should conservatively be at least $40k. Taxes are not an issue, as Allied has NOLs of almost $1m. All of this brings us to 12 months’ earnings of $256k or $0.05/per share: (ignoring unrealized investment gains/losses)

Because Allied hasn’t spent on CAPEX in quite some time, I consider our earnings figure to be a good proxy for cash flow – as we keep depreciation & depletion to act as our CAPEX number.

If these assumptions are reasonable, and I believe they are – we get a forward P/FCF of only just over 5x, or literally “free” free-cash-flow if you use enterprise value.

Put more bluntly, at current market prices one could (theoretically) buy the whole company using its own cash & securities, with $214k left over – and collect another ~$250k in the next year while not having to pay any taxes on these earnings. Furthermore, considering the consulting fee would be gone, this amount would be ~$370k. Not bad!

Realistically, no one is going to take this action. For the common shareholder, intrinsic value is around ~$0.50 (net cash per share of $0.25 + a 5x multiple on forward cash flow per share of $0.5) or about 100% upside.

Risks/Downside

The biggest risk to this investment is naturally the chance that energy prices fall. Truthfully, I don’t have any special insight in this regard, but considering the ongoing supply issues, the near-term future looks safe. The fact that Allied managed to not burn through its cash & equivalents during the Pandemic energy crash, gives me confidence that there isn’t much material downside, even if such an event happens. As income dried up, Allied successfully managed its cash flows – increasing payables/pushing out payments, and collecting receivables quicker:

As a result of this superb cash flow management, interest income, and misleading unrealized losses on investments, cash flow was never hit as hard as you would expect from looking at GAAP earnings. To be more precise, the downside is around NCAV ($0.25 or 6%).

Another concern one may have is management. The CEO is Ruairidh Campbell, he owns 36% of the stock and is also the CFO and a Director. The other two Directors are Ed Haidenthaller and Paul Crow, each with only 10k shares to their name (<1%). We already mentioned the concerning consulting agreement the company has with Ruairidh, but there aren’t really any other big red flags that I have come across. He is the CEO of another public company, Arvana, Inc. (AVNI), a pink sheets shell company. They tried to make an acquisition in 2021 that ended up falling apart and are currently seeking new opportunities. Although management is of course a risk, there isn’t nearly enough evidence to justify the implied discount. Still, one must be at least mindful of the overwhelming control the CEO has over the company.

The biggest concern is that shareholders won’t see any of the cash flows that Allied generates. They don’t have plans to pay a dividend and there haven’t been any stock repurchases. This is a very valid concern, but again, evidence has yet to be found to prove that management is out to enrich themselves at the expense of shareholders (aside from the consulting fee, which one must concede is concerning – though it doesn’t look like the CEO takes a salary, so perhaps it’s not so bad).

Needless to say, a downside of almost nothing and an upside of 100% is attractive.

As always thank you for reading! Constructive criticism is extremely appreciated – I’m just trying to learn and get better!

Disclosure: None of this is investment advice. Always conduct your own due diligence before investing in any security.

Nice writeup! I do find it a bit odd the company owns assets in WV and Texas, is addressed in Utah, but incorporated in Nevada (which I've been told is at least a yellow flag). Have you been able to make contact with the CEO?

Also, you'll probably want to include the in-the-money options in your share count. Thanks for posting!

Do you know why they decided to go public?