NoCopi Technologies, Inc. (NNUP): Hidden Revenues, Hidden Agenda's

Undervalued or appropriately discounted for risks?

NoCopi Technologies, Inc. (NNUP) markets specialty inks in the educational and toy markets. Their Rub-it & Color technology is used for coloring books, greeting cards, activity kits, and other paper-based applications. NoCopi is minuscule for a public company, they only have four full-time and two part-time employees. Shares currently sell for around $0.16 and there are about 67m shares outstanding, giving NoCopi a market cap of over $10m. NoCopi has little debt and cash of $2.13m.

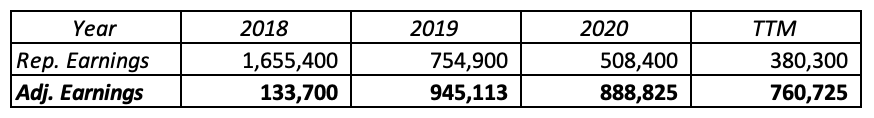

At first glance, NoCopi looks like a company on the decline. Their reported earnings in 2018 were $1.65m, this fell to $754k in 2019, about $500k in 2020, and $380k in the last twelve months. However, these numbers are deceiving due to NoCopi’s revenue recognition rules. In the 2nd quarter of 2018, they signed a 4-year contract that pays out over the duration of the deal. (Starting in the 3rd quarter of 2019). However, they booked all of the revenue in the 2nd quarter of 2018. (Hence why 2018 earnings were so high). The amount booked from the contract was $1.521m, in reality, this sum was/is going to be received over a 16 quarter period starting in the 3Q 2019. As a result, ever since, quarterly earnings are almost $100k higher than reported.

Here is a table of the earnings before and after we adjust for the effects from the revenue recognition rules:

Based on current prices NoCopi is trading at only 9x adj. free cash flow and 3x adj. earnings net of cash. After adjustments, their return on invested capital is almost 50%, and their return on equity is over 20%. Although the revenue recognition rules make earnings choppy, the company has delivered over 40% CAGR in free cash flow, pre-tax income, and earnings, since 2013.

Alright, so the company is very cheap but why? The issue with NoCopi is the abhorrent, disgusting actions of its CEO and Board. They have shown absolutely no regard for shareholders and are the poster child for how one should not run a publicly-traded enterprise. The current CEO gained control of the board and company in 2000 after a successful activist campaign. That year, 22 years ago, was the last time NoCopi held a shareholder’s meeting. Since 2000, the CEO has implemented new bylaws to make it near impossible for shareholders to add board members, he also gave himself a huge raise. He didn’t fulfill any of the things he promised in his activist campaign and shareholders have paid dearly. I’m not sure I’ve ever seen a more suspect setup; the audit committee consists of just the CEO, which is a huge red flag, and quite bizarre. Not convinced? The CEO seemingly committed illegal insider trading when he dumped tons of his shares right before reporting a near 30% drop in earnings back in December of 2020. There are far too many red flags to list them all so for now I’ll end with perhaps the oddest of them all: The company is registered in the State of Maryland. Despite NoCopi conducting all of their business from Pennsylvania.

Maryland? Not Delaware? Not even an offshore tax haven like the Cayman Islands? Nope. Maryland…

Most American companies either register in their state of operations or Delaware. Choosing Maryland makes no sense from a tax or financial standpoint, at least that I can tell. My guess is the company decided on Maryland to take advantage of lax corporate laws.

In addition to their apparent disdain for shareholders, NoCopi’s leadership has also failed to maximize the company’s performance. NoCopi doesn't take advantage of employee retention tax credits, nor research and development credits. During the Pandemic, they didn’t even get a PPP loan.

However, there is reason for hope…

Recently a well-known and highly respected hedge fund manager in the micro-cap space - Tim Eriksen - has started building a large position in the company. He is beginning an activist campaign to win a seat on the board and help implement shareholder-friendly policies as well as improve operating results. Mr. Eriksen has a history of not only winning board seats for himself and his allies but of taking over companies with awful leadership and replacing them. He did this at PharmChem, and Solitron Devices, where he is now CEO. (Both of these companies will be featured and written about soon). Because NoCopi refuses to take shareholder demands seriously, or grant any concessions, Eriksen is now moving forward with a proxy fight. He submitted a written request from 25% of the shareholders to demand a special meeting. The company of course rejected the request. However, they went a couple of steps further as well. They made decisions to classify the board and limit shareholder power to remove/change directors. Their actions mean that, among other things, shareholders are prevented from voting on directors for at least another two years.

On the bright side, they did announce they plan to hold a 2022 shareholders meeting this spring/summer, although no filings have been made and it would be unwise to assume they will stay true to their word.

Here is the link to Erikson’s proxy filing, it is well worth the read.

Considering Tim Eriksen’s proven track record in dealing with these kinds of situations, I think he will succeed, however, it will likely be a long and expensive process for all parties. I am not well informed in Maryland corporate law nor do I have a reasonable estimation of Eriksen’s odds in court, but at minimum, I believe Eriksen will win a board seat or two. Such a scenario would prove valuable to shareholders and push NoCopi in the right direction. However, because of NoCopi’s continued rejection of any agreements or compromises, I believe it’s likely he will take over. Hopefully, he does but there are no guarantees he will be able to win anything. If the activist campaign completely fails and the CEO and Board prevail, NoCopi will be just about as uninvestable as a company can be.

Quick valuation/Price target:

Given NoCopi’s fast-growing annual free cash flow of over $1m and solid/proven business model with clear room for growth, I think shares are worth at least $0.30 now (~$20m market cap, ~100% upside). However, if Eriksen takes over I think the value of NoCopi will be more in the range of $0.45-0.50/share, just based on his track record of massively increasing shareholder value with similar companies. There aren’t many firms that compound cash flows and earn high returns on capital that have stock selling for <10x FCF. The risks are gargantuan, no doubt, but I simply cannot ignore potential gains of 100%+ at such a cheap valuation. Nor can I look past the opportunity to assist activists in removing crooks.

I’m making NoCopi a small (<5%) portfolio position. I am excited to see what the future holds.