PD-RX Pharmaceuticals (PDRX) - A Profitable 'Net-Net'

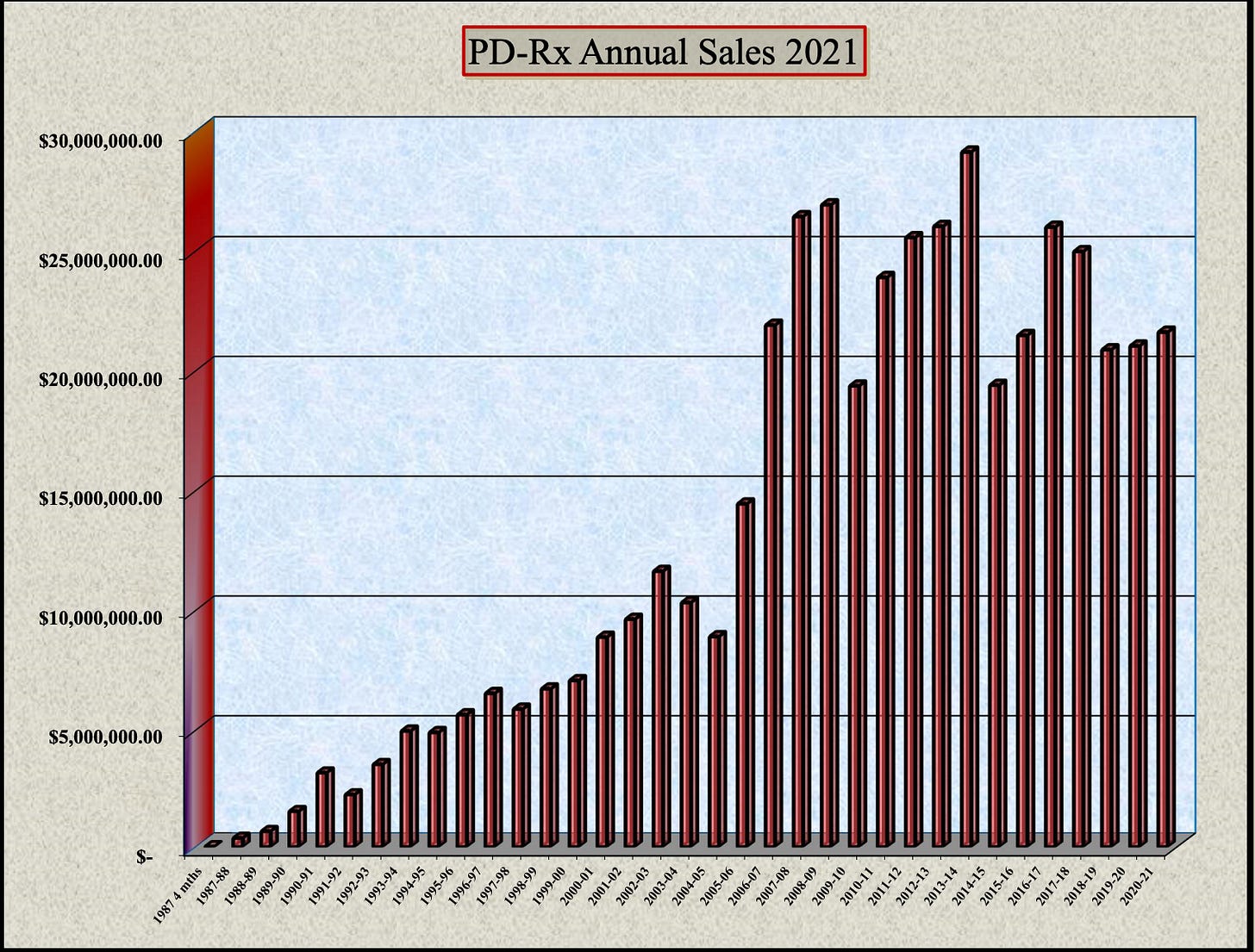

PD-RX Pharmaceuticals, Inc. (PDRX) is a tiny ~$5m market cap company that supplies generic and brand pharmaceuticals. According to their annual report, PDRX offers over 2600 prepackaged medications and over 2000 pass-through items such as creams, ointments, ophthalmics, liquids, etc., The company also has a dispensing platform that can be used to track prescriptions and print prescription labels. The company has been in operation for 34 years and recorded profits in most of those years, in addition, to slowly growing sales. Below are two figures from PDRX’s annual report detailing sales and income over the last 34 years.

As you can see in the income graphic, PDRX was negatively impacted by the COVID-19 pandemic, although they have since recovered. Earnings in 2020 were -$384k (EPS of -$0.22), 2021 earnings were $1.8m (EPS $1.06). 2021 earnings are misleading as they include an $933k increase relating to the extinguishment of the companies PPP loan. Adjusting for that impact, earnings in 2021 were about $0.51/share. With shares currently only trading for around $3, this makes for an attractive adjusted P/E multiple of only 5.8x.

But the true value of PDRX, is found in the balance sheet accounts. PDRX’s balance sheets are the definition of ‘pristine’. The company has no debt, and over $9.9m of assets compared to only $2.4m in liabilities. PDRX doesn’t even record any lease payments as they own their 27k square foot production and warehouse facility. (Pictured below - from annual report)

Net cash per share is about $1.70/share and Current Assets - net of all liabilities - is $4.42/share. Thus currently the market is valuing PDRX at only 2/3rds of its NCAV and its assigning no value to their decent earnings power. With valuations of this level, you would expect PDRX to be burning through cash and book value to be rapidly deteriorating. But this simply is not the case. Last year book value grew by 28% and NCAV grew by 33%. Cash was a little lower in 2021 but this was due to an increase in receivables and inventory, not to expenses or other common burners of cash.

At a 40% discount to book value and a 33% discount to NCAV, it is not hard to see why this stock piqued my interest. The company is listed on the expert markets, so of course, there are many risks and concerns to keep in mind. PDRX only reports financials annually and does so through its website. Shares are incredibly illiquid have become ever more thinly traded since the SEC implemented rule 15c2-11, effectively barring brokers from providing quotations for expert and gray market securities. There are many other risks that you should consider when analyzing PDRX, for example 46% of their 2021 revenues are attributable to one customer (up from 34% in 2020) as is almost all of their accounts receivables. But I believe the deep discount to NCAV and Book Value provide a strong margin of safety.

With a share price that isn’t even trading at 2x adj. earnings net of cash, I think PDRX offers incredible value to astute investors.

As always, none of this is investment advice and you should always conduct your own thorough analysis before making investments into any security. I do not own shares of PDRX as I am not considered a ‘qualified investor’ by my broker (usually this refers to the amount of money you have), therefore I am not eligible to trade in these non-reporting securities.

Thanks for reading and I would love to hear your thoughts and feedback!