Potential 78% Annualized Return - Special Sit: Metacrine, Inc. (MTCR) & Equillium, Inc. (EQ)

My first stab at a arb(ish) situation

Background

Last Tuesday, Equillium, Inc. (EQ) and Metacrine, Inc. (MTCR) announced via SEC filings that they had entered into a merger purchase agreement. Pursuant to the terms of the agreement, EQ will essentially purchase and merge MTCR into one of its wholly owned subsidiaries, in exchange for considerations via EQ stock issuance - which I calculate to be worth 34% more than MTCR’s present market value.

The deal includes a not-so-insignificant termination fee for both parties, indicative of the respective firm’s commitment to getting the deal done. Furthermore, the transaction is expected to close in the next few months, pending shareholder approval (I estimate 6 months, more on that later).

A highly likely, annualized potential 78% gain? One would expect MTCR’s stock price to reflect this news in short order… however, its stock has hardly budged. Yesterday, MTCR closed at just under $0.48, only $0.02 (or ~4%) above where it closed on September 2nd, the last trading day prior to the announcement.

(chart from google finance)

Naturally, this begs the question…

Why?

As is the case with many transactions of this kind in the biotech industry (including another one I am currently writing about), the terms of the Merger Agreement are complex, with the value of the consideration to be received based on various ever-changing variables:

“In connection with the Merger, all of the issued and outstanding shares of common stock of Metacrine, par value $0.0001 per share (the “Shares”), will be cancelled and converted into the right to receive consideration per share consisting of (i) the exchange ratio (the “Exchange Ratio”) determined by dividing (x) (a) 125% of Metacrine’s net cash as of the closing of the Merger (the “Closing”) by (b) the price per share of common stock of Equillium, par value $0.0001 per share (the “Equillium Common Stock”) determined based on the 10 day trading volume weighted average price per share of Equillium Common Stock calculated 10 trading days prior to the Closing date, provided that the price per share of Equillium Common Stock shall be no less than $2.70 and no more than $4.50 by (y) the aggregate fully diluted shares of Metacrine, plus (ii) any cash payable in lieu of fractional shares of Equillium’s Common Stock. The Merger is intended to be a taxable transaction.”

(Form 8-K, SEC Filing)

Simplification/Formula

To better understand and calculate this potential consideration value, let’s translate this into plain English: (Note: my labels of the variables are not intended to match up exactly with those in the description from the filing above)

MTCR shareholders will be issued (x) number of EQ stock at the (y) exchange ratio. Multiplying the (y) exchange ratio by EQ’s closing stock price gets you the (z) Total Value of this consideration.

Further breaking each of these down:

MTCR stock will be converted into (x) number of EQ stock

(x) = (MTCR’s Net Cash * 1.25) / EQ’s 10-Day VWAP

EQ has imposed a $4.50 ceiling & $2.70 floor on the 10-Day VWAP (more on this later)

(x) will be distributed to MTCR shareholders at the (y) Exchange Ratio

(y) = (x) / MTCR’s Outstanding Diluted Shares

To finally get the (z) Total Value of The Consideration, we have to multiply the (y) by EQ’s closing stock price

(z) = (y) * EQ’s Closing Stock Price

Calculations:

First, to calculate x, we must estimate MTCR’s net cash at the transaction’s close. Based on MTCR’s MRQ filing, I’ve calculated its Cash and Short-Term Securities, net of all liabilities at ~ $37.87m. Net Cash, without including short-term securities, is $27.69m.

This is interesting because, during a conference call on Wednesday, EQ’s management stated it believes MTCR’s Net Cash position at close (estimated to be in “a couple of months”) will be ~ $26m. Detailing their estimates, EQ’s management explained they expect MTCR’s net cash balance at the transaction close to be $33m, but in order to account for incremental debt and transactional/miscellaneous expenses that number was further reduced to $26m.

$33m net cash before the additional transaction/miscellaneous expenses assumes a net cash burn of roughly $5m over “the next couple of months”. This checks out…

MTCR burned ~ $22m through its operating activities in the last 6th months (1H 22), and in the first half of 2021. However, it offset these respective outflows with $14m (1H 21) and $18m (1H 22) of net liquidations and maturities in its securities portfolio (net of further Purchases of ST Investments). In other words, net cash burn was ~ $4m over the last sixth months (1H 2022), and ~ $8m over 1H of 2021… Giving us a range that is in line with EQ expectations (This is also why I believe the transaction will close in ~6 months’ time). Calculations below:

Next, we must put a 25% premium on this net cash number, getting us $32.5m.

Finally, to finish our calculation for x we divide this net cash (at premium) number by EQ’s 10-day VWAP. Currently, EQ’s shares trade at $2.29, below the $2.70 floor where they traded prior to the merger announcement. To be conservative, let’s assume the 10-Day VWAP stays below/at $2.70 per share, causing the floor price to be used:

At this point, we can now calculate the y (Exchange Ratio) by dividing the newly issued stock by MTCR’s diluted outstanding shares

Finally, to get z (Total Consideration Value), we multiply the Exchange Ratio by EQ’s share price. Doing so shows that MTCR is trading at a 34% discount to the expected value of the transaction consideration:

To Arb, or not to Arb

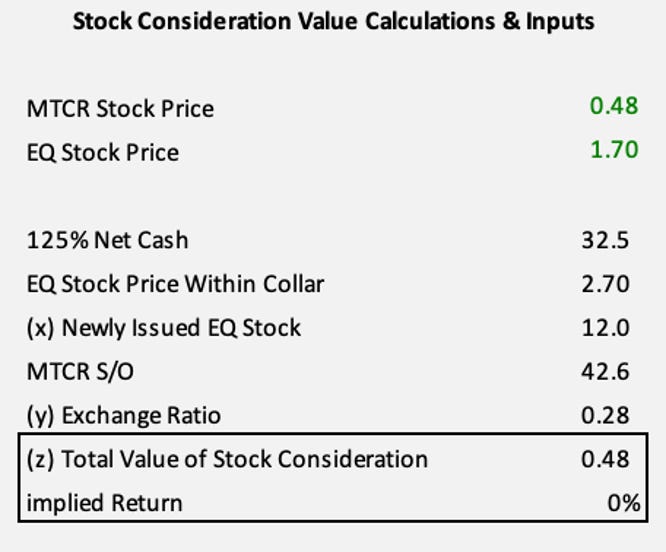

Attentive readers and those familiar with this type of transaction will have noted how dependent the implied return/value is on the prices of MTCR’s & EQ’s stocks. For example, in the following graphic you can see all the inputs and calculations:

(Above is not my original work - it’s a spreadsheet my mentor was kind enough to share with me. I just altered some of the labels and added a title)

Now, look what happens when I adjust EQ’s stock price down 10%:

That is a significant ~38% decrease in implied return based on only a 10% decrease in EQ’s stock… Of course, normally following the announcement of this type of transaction, the stock price of the acquirer goes down, and that of the acquired goes up. However, MTCR’s stock (as previously discussed) has hardly moved, while EQ’s has tanked ~20%:

(chart from google finance)

Traditionally, one would mitigate this risk through arbitrage, by shorting EQ… For example, we can calculate the implied price of EQ, by dividing the price of MTCR’s stock by the Exchange Ratio:

To verify and check our work, we take this implied price of EQ and plug it into the current stock price, getting us an implied return of nothing:

However, I don’t believe shorting EQ is a prudent strategy to mitigate this risk. For starters, EQ’s stock has a potential catalyst:

EQ will be getting data on its lupus nephritis program soon, which pending the results, could potentially send shares upwards (This is why management put a $4.50 ceiling in to cap the potential consideration value).

Additionally, shorting EQ is a very risky proposition (despite what the recent price action would tell you) as from its shareholders point of view, the deal is actually somewhat decent. Despite its dilutive features, the deal enables EQ access to cash which management believes will “extend (its) runway comfortably into the 2024 timeframe”. Additionally, it brings in two development stage programs that may have some potential. The alternative to this deal for EQ was a dilutive equity raise… however, one imagines the present market environment doesn’t exactly lend itself well to unprofitable development stage biotechs raising cash at fair equity valuations.

All of this to say - there seems to be a good chance that EQ’s shares adjust upwards in the coming months. Based on the implied stock price, as long as EQ’s shares don’t further fall by 25% ($1.70), the downside for MTCR shareholders is essentially nothing. It seems unlikely EQ shares would go down further by 25%, as that would likely require some truly disastrous data results for the lupus nephritis program. Given management set the floor based on where EQ was trading prior to the merger announcement without any further discount, I reckon they are confident the results will be positive. All in all, an investor in MTCR may realize a satisfactory gain from this situation without needing to approach it in the traditional arbitrage manner.

Thanks as always for reading! Critical feedback is always appreciated!

Disclaimer: Absolutely none of this is investment advice. This and all my past and future write-ups are intended for my own development/educational purposes. You should always conduct your own due diligence prior to making an investment in any security.