Solitron Devices (SODI): Operating Leverage & Growth at only 3x Earnings net cash

What am I missing?

Solitron Devices, Inc. (SODI), manufactures and markets semiconductor components and related devices for the aerospace and defense industries. Both these and the electronic component industry are extremely competitive - manufacturers are constantly threatened by the rapid development of new technologies and foreign competition. However, Solitron has found a niche that insulates them from many of these threats. Over 85% of SODI’s sales are from application-specific devices, these custom-made products are designed specifically to meet the needs of a customer’s particular program. These products are mission-critical to customers, and they have been used in some of the most important military and space programs in our country’s history. As a result, customers place far more importance on component quality and manufacturer reputation than they do on price.

Solitron, despite being a tiny company ($20m market cap), has a strong reputation and a rich history to back it up. For example, components manufactured by SODI have been used in the Moon Lunar Roving Vehicle, the Galileo spacecraft, the Mars Global Surveyor, and the Mars rover.

The military programs that SODI supplies are of great importance to national security, for example, the MIM-104 Patriot, the primary air defense missile system used by the Army.

Because reputation and quality are of paramount importance, it is very difficult for new competitors to come in and take business away from SODI. There are two additional things about SODI’s niche that make it so attractive:

SODI’s Business is “sticky”

Compared to the projects their products are used in, their components are incredibly small - yet so crucial

Customers are very unlikely to switch suppliers after agreeing to a contract, as it’s prohibitively expensive and time-consuming

Defense Industry programs are long-lasting

Thus once SODI earns a contract they are essentially locked in until it ends

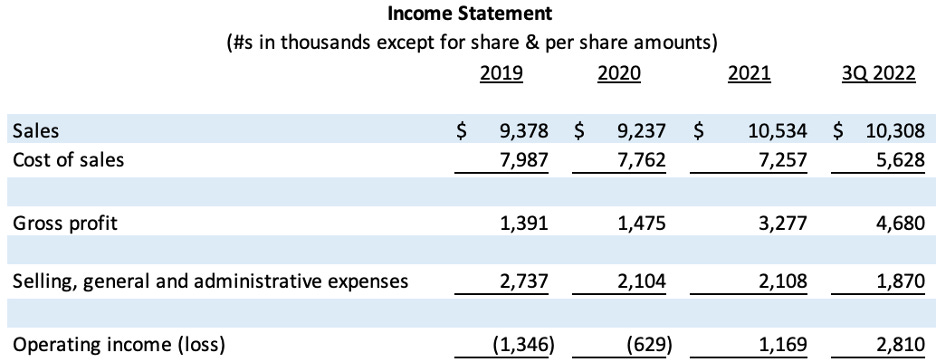

These attributes inherent to SODI’s operations help them generate consistent and long-lasting revenues. As a result, SODI is far removed from the highly cyclical and speculative nature applicable to most other semiconductor companies. No doubt, all of this is fantastic, but my favorite thing about SODI’s business model is its utterly insane operating leverage. The majority of SODI’s expenses are fixed costs, thus operating margins grow way faster than revenue. As a result, even marginal growth of revenue has a big impact on earnings. To prove this point, see the below snapshot I put together of SODI’s top-line numbers in recent years:

As you can see, revenues have hardly grown at all in the last ~ 3-4 years, yet operating earnings skyrocketed due to the reduction in COGS and SGA expenses. Because of this operating leverage, all SODI really needs to do to be successful is continue earning contracts. Management has been successful in this regard recently, but it wasn’t always that case.

Enter SODI’s current CEO, Tim Eriksen – those of you familiar with the space & readers of my analysis on Nocopi and PharmChem will be familiar with his name (perhaps a bit generous making ‘readers’ plural). I don’t want to take up space rewriting anything, but for those unfamiliar; Tim is a well-known micro-cap hedge fund manager who has successfully turned around several underachieving companies. Tim took over SODI in 2015 after running a successful activist campaign. Before Mr. Eriksen arrived SODI was in danger of losing its biggest customer, Raytheon. Additionally, the previous executives were guilty of rewarding themselves with egregious compensation packages despite underperforming – unfortunately a very common two-piece combo in OTC land. Since Eriksen took over, sales have grown 50% from ~ $7m in 2015 to what should be about $10.5m at the end of this year. Of greater importance though, SODI has repaired their relationship with Raytheon, even recently being named their preferred supplier.

It should be noted that the majority of SODI’s growth occurred in the most recent few years. Much of Eriksen and co.’s time at SODI early on had to be spent on stabilizing the company and turning it around for the future. Both these, and some issues regarding inventory accounting caused a lot of one-time expenses that kept the company from posting profits for a few years. But they have gotten the ship back on track, and SODI is now entering growth mode. Earnings in 2022 are at $3m, and that is after removing the gain recorded on forgiveness of the PPP loan (from here on all earnings are adjusted for PPP). That is more than double 2021 earnings ($1.4m)!

SODI has about $10m in NOL carryforwards to offset future taxes (only $837k expiring before 2029!). Another brilliant thing about SODI is that maintenance CAPEX is normally about equal to depreciation, thus operating earnings are a great proxy for earnings power and free cash flow. Though, as of the 3rd quarter, free cash flow is technically negative because of an unusually high $4.9m of CAPEX. But this is almost all due to SODI’s recent purchase ($4.7m) of a new facility/headquarters, and management believes this will result in annual cost savings of approximately $1m. Two more short-term headwinds to keep in mind:

Management expects the fourth quarter will be very soft (revenues estimated to be $1.5m)

Not surprising, the plan this year was to aggressively produce in the 1st half so they could relocate in the 2nd.

Since the 4th quarter is going to be soft, its likely year-end results will be about what they are now as of the 3rd quarter.

Low bookings don’t bode well for 2023

Due to COVID 19 and delays in contract awards, bookings have been lighter than hoped.

Bookings are very important because they offer insights into future sales - typically, sales come 6-9 months after receipt of bookings

Regardless, the future looks bright. After 2023 I expect earnings & margins to take off. Gross margins are growing and currently, at 45%, the story is the same with operating and net margins each at around ~ 30%. Lastly, SODI’s balance sheet is pristine, the company has a growing pile of cash and securities that is currently worth $5.2m (almost $3m net of all debt).

With SODI’s operating leverage, NOLs, plus the additional cost savings from the new facility, it is not hard to imagine their earnings could grow by 20% y/y in the future. Sure, revenue hasn’t grown much, but now that management has stabilized the company, they will be able to put more focus on growth.

What multiple of earnings power would you pay for a company with 30% net margins, 20% earnings growth, a superb balance sheet, and fantastic management? Perhaps something like 15-20x earnings? Well, how does 6x sound - or 3x if you include cash? That’s what shares are going for right now at $9.50 – 9.85 apiece. Given SODI’s characteristics, I estimate their intrinsic value is more than double the current price. I think this is a $50m company, that’s $24/share and still only 16x earnings!

Thanks for reading! As always none of this is investment advice, you should always do your own due diligence before investing. Microcaps are also subject to more risks such as illiquidity, reporting concerns, etc., Disclosure: I own shares of Solitron and it is a core position of my portfolio.

Thanks for the analysis, I'm long on SODI.

Hey William, i throughly enjoy your write ups and back story. I am also currently a college student, senior to be exact. I am also what you would call a “value investor” or “net net” investor. If you are open to talk more about investment ideas let me know. I have a few investment ideas that might interest you. Let me know.