Special Sit or Fraud? Brookmount Explorations, Inc. (BMXI)

Potential Up-listing, but is it worth the risks?

Before diving in - this is not going to be like one of my traditional write-ups. However, it’s interesting and I think it’s worth analyzing. I hope you enjoy it!

Brookmount Explorations, Inc. (BMXI), is a pink sheet listed penny stock that engages in gold mining on various properties in Canada, Alaska, and Indonesia. They are registered in the State of Nevada…

I know, Red Flags everywhere… there’s more…

The CEO owns no stock in the company (directly).

Lots of pumping on Twitter (just look up the “cash-tag”)

Severe share dilution due to convertible notes, S/O increased 31% since July 14th (MRQ report)

According to their March SEC filing prospectus, we should expect to see a further 11.9% dilution, bringing total S/O to 42.795m (they will have to dilute much more though)

BMXI’s 2021 report and those subsequent exclude calculations/information regarding diluted shares outstanding… perhaps intentionally?

In an effort to alleviate shareholder concerns regarding dilution, BMXI announced on the 24th that they were reducing authorized capital to 100m (from 2bln!) & submitting an official request with the Nevada Secretary of State by the end of the week. 08/24 was a Wednesday, so presumably, that meant the request was to be filed by the 26th (Friday)… Thus far, no request has been filed… (https://esos.nv.gov/EntitySearch/BusinessFilingHistoryOnline) though it’s certainly possible when they said, “by the end of the week”, they were referring to the 7-day period ending the 31st.

Considering all this information, you would be forgiven for thinking I’ve gone mad deciding to spend more time analyzing this company. However, despite its obvious flaws, Brookmount is incredibly difficult to ignore for two reasons:

Insane Valuation

0.16x Book Value

0.55x TTM Earnings

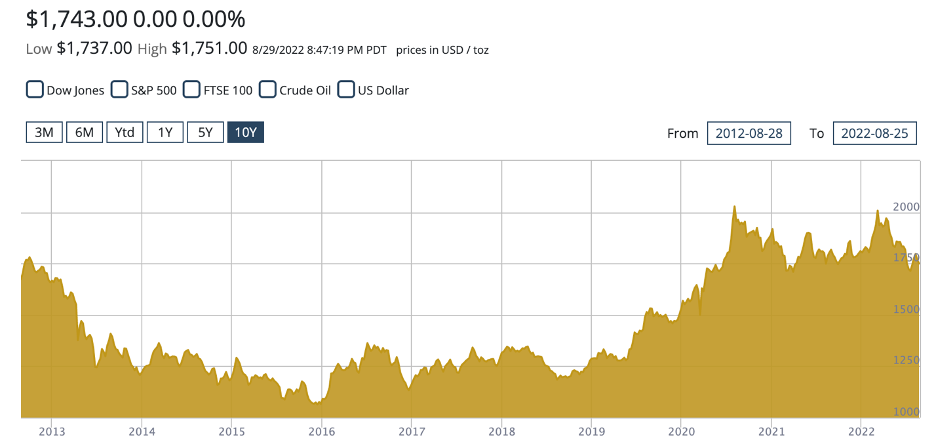

Clear Catalysts (See below Image)

Up-listing to NYSE or NASDAQ

Release of 3Yr PCAOB Audit

(otcmarkets.com)

Not to mention – the stock has fallen in recent days to $0.1035:

(Tikr.com)

What do I make of this situation? Well, even if we assume the accounting is legit, BMXI’s undervaluation is exaggerated using Book Value, and Earnings. More importantly, further analysis of these metrics reveals some serious cash flow concerns

Book Value Analysis

Here is a screenshot of BMXI’s Balance sheet as of the MRQ:

As you can see, current assets are practically non-existent – the biggest assets, and thus contributors to Book Value are Land Usage rights, and Receivables from non-affiliates. Land Usage rights are of course valuable, but the amount listed on the balance sheet is just representative of the continuous cash outflows that must be made to acquire them. What the true “realizable” value of those rights are… who knows? The “Receivables due from non-affiliates” item is bizarre - on the statement of cash flows, this item is listed as “non-affiliate loans”. Unfortunately, BMXI’s filings include no information on what these receivables/loans are. I’ve tried calling executives for clarity, but I haven’t been able to reach anyone except IR. My best guess is these have to do with the convertible loans BMXI issued. If I can catch the upcoming Q&A session I will ask for details.

Regardless, it’s clear that Tangible BV is much lower than BV – though how much depends on if you view the receivables/loans from non-affiliates as tangible or intangible. Assuming it is a tangible asset, I calculated BMXI’s Tangible Book Value and its current TBV multiple:

As you can see, the stock still looks very cheap…

Earnings Analysis

Unlike many of the companies I look at, BMXI actually has a really clean Income Statement:

However, as I previously alluded - Earnings are significantly misleading due to the large cash outflows BMXI has occurred due to changes in NWC (from Non-Affiliate Receivables/Loans), and CAPEX (from Land Usage Rights). Land Usage Rights are not traditionally classified as CAPEX, but I don’t see how you could classify it as anything else considering it is a necessary expense for BMXI’s mining production over the next 20 years (duration of the rights).

For the sake of visual portrayal – below is a comparison of BMXI’s Earnings to Free Cash Flow – with, and without including land usage rights in CAPEX:

As you can observe – There is a stark difference between the two FCF formulas. Again, I believe the bottom one is the appropriate metric. Still, it makes for a 20% FCF yield.

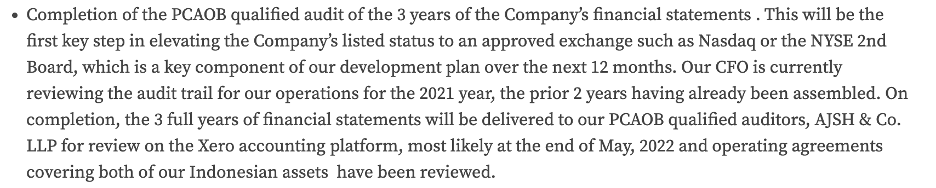

The inherent problem with valuing BMXI on cash flow is that as an early-stage exploration company, there isn’t enough information on its properties to project out CF. And as previously discussed, valuing BMXI based on its book value, tangible or otherwise, presents its own set of problems. Even if we did have a perfect view of BMXI’s BV, it’s imperative to consider future cash burn, which should be significant given the nature of their operations. On that note, I’m 100% certain that BMXI will need to raise capital moving forward, through debt or equity. Most likely this will be achieved through equity, as they will have a hard time getting loans this early on in exploration. This is why the potential reduction in authorized shares is so important to investors. For example, look at what happens to BMXI’s valuation at 100m shares vs 200m shares (current A/S) - assuming shares are issued at $0.12:

Now Imagine, if that number was 2bln or even 500m!

(I realize there are a ton of problems with the assumptions in the data above - it’s not meant to be taken literally)

I have never analyzed a company in this industry before, and to make things even worse - I have very little information to work with as BMXI is in such an early stage. Although I don’t have data to value each of their properties, I have put everything I could find below.

Properties

First up is the newly acquired McArthur Creek (Alaska) Property

The Alaska acquisition cost BMXI the issuance of 1m shares (no word on what $/PS) & $300k in reimbursement expenses for previous development expenses (this will come out of subsequent revenue generated on the property). Additionally, BMXI agreed to split net revenues on a 60/40 basis, after the initial $300k payment.

This is the most difficult property to value, as there is not a lot of information available given it was so recently acquired (late July). You can see in the presentation below, the historic production is very low:

Below are the details of the capital investment, BMXI is putting in to the project:

Hopefully, future production is much higher than historic, or that investment won’t look too good.

Next is the Yukon Property of the Moosehead Project (Canada)

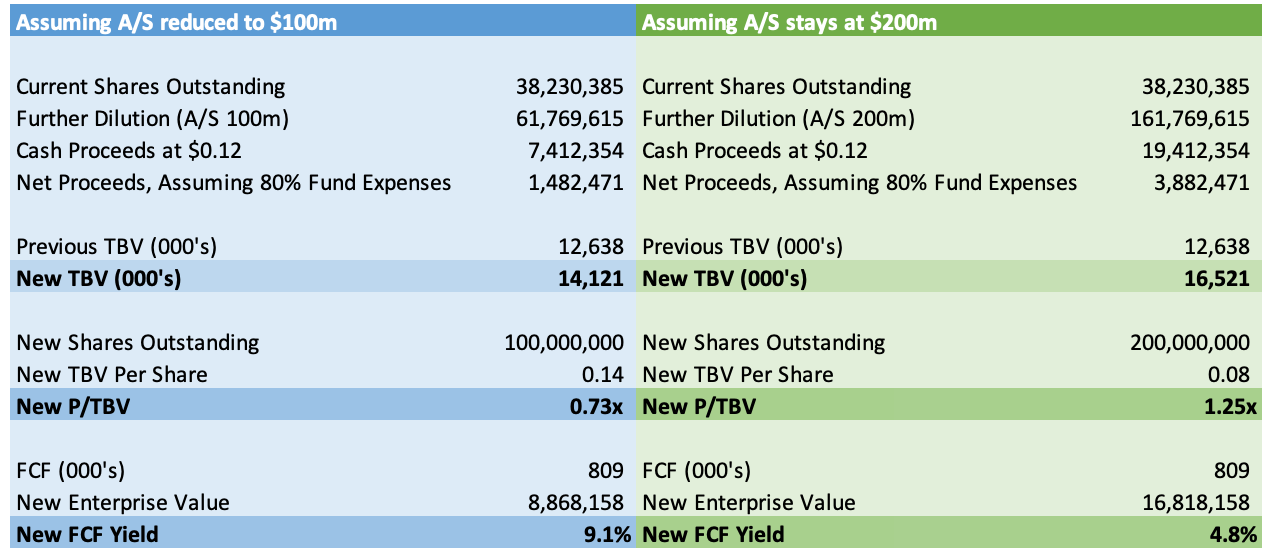

The Yukon Property was acquired in June 2021, for a 25% equity stake in BMXI, a commitment to invest not less than $1.65 for the purchase of the property and in further development of the operations, as well as a 2.5% Net Smelter Royalty. This is all rather confusing because on BMXI’s website they claim they own the entire Moosehead Project. I suppose they do technically own all of it, but that seems misleading as one must account for the royalty, so the revenue isn’t going to be 100% to BMXI. On the Brightside, the entire project has a NI 43-101 confirmed resource of 39,040 oz au. With Gold currently at $1,743/oz – that’s worth ~$68m. Not too shabby. See chart below for the Price of Gold per oz:

Next is another Canadian property, this one is in the Tintina Belt

This property was acquired for 4.5m shares and $1.8m in cash payments with the following payment schedule:

Again, this is an incredibly capital-intensive operation – I don’t see how further dilution is anything too short of the potential 100m total cap.

BMXI’s other two properties are both in Indonesia, risky operations in many ways to say the least. Both properties are covered by 20-year operating agreements, and the company has invested ~$2m in acquiring and developing these operations.

The first Indonesian property is the Talawaan Facility

BMXI spent $500k to acquire the property, and operating costs to date are estimated to be ~$1.5m. Random sample testing indicates average ore grades of around 2-5 grams per ton. Below is a map of the facilities:

The second Indonesian property is the Alason Facility

Acquire in 2015, the Alason Facility is the most bizarre. It wasn’t operated as a business prior to its acquisition – furthermore, BMXI has not conducted any drilling programs or commissioned an NI 43-101. The responsibility of overseeing mining activities at the property has remained with the previous owner. Below is a picture of the facility:

Already in this section, we see that BMXI will have to spend at least ~$1.6m in payments to Hartley, and almost $2m for the Alaska project. That’s a ton of cash for a company without much of its own. And this doesn’t even include the usual expenses their operations will incur.

If they can mine that $68m of gold at the Moosehead Project at a decent margin, an investment at these levels is likely to do well. But there are so many ways this can go wrong - the biggest concerns are:

Uncovering of Accounting Shenanigans

No Uplist or Audit

Price of Gold Crashes

At the current valuation, I think these concerns are priced in, and I like the risk/reward. If they do up-list - based on competitors listed on the higher exchanges - 1x TBV sounds right. Of course… who knows what TBV will be at that time.

Thanks for reading! Let me know what you think!

Disclosure: None of this is investment advice. Always do your own Due Diligence before making any investment.