If you notice a difference in writing format… I recently finished reading a fantastic book Pitch the Perfect Investment by Paul Sonkin and Paul Johnson (highly recommend) - and I am trying to apply what I learned. This is less of a pitch and more of a informative write-up so its not fully applicable. As such the piece is a lot longer than it would otherwise be because I went more in depth to the history, though I did put this at the end. Also I didn’t state my thesis nearly soon enough. But expect that to change in the future.

I came across a very enticing stock today (April 28th, this will probably be published on the 29th or 30th) (oops or the 1st of May). I was running a very simple screen on Tikr and I noticed a tiny American company that I wasn’t familiar with. When I say tiny, I mean it, this company has a $2.6m market cap. Is that even big enough to be a “nano-cap”? I’ve heard the term “pico-cap” thrown around before, maybe that’s more appropriate. I don’t know, but anyway, the size alone made me interested. However the more I dug into this company, I quickly realized there is something special here:

Executive Profile:

Kelynaim Global, Inc. (KLYG), produces custom-made cranial implants to replace damaged bone structures using Bio-Computer Aided Design (CAD) and Computer-Aided Manufacturing (CAM). By using a patient’s CT scan they are able to provide precision replication, and patient-specific cranial implants as fast as 24 hours, after receival of approved CT scan.

These products are important to surgeons, and patients alike. There is no room for error, and quality is of the highest importance. KLYG has proven itself to be a high-quality manufacturer, and its proprietary designs are among the most durable available. As you can imagine, in the surgical world, time is of the essence. It is KLYG’s ability to directly deliver their custom implants in less than a day, as well the quality of their products, that gives them their competitive advantage.

Summary Data

Admittedly, the summary data doesn’t look all that interesting. CAGR’s of 8%, 13%, and 12%, respectively for revenues, gross profits, and operating income aren’t anything to write home about. Even worse, bottom-line numbers are overstated in 2020 & 2021 because of PPP forgiveness. Even with the PPP benefits, at $0.008 EPS, KLYG is selling at 13.7x earnings - Far from the usual bargain issues that readers are used to me writing about.

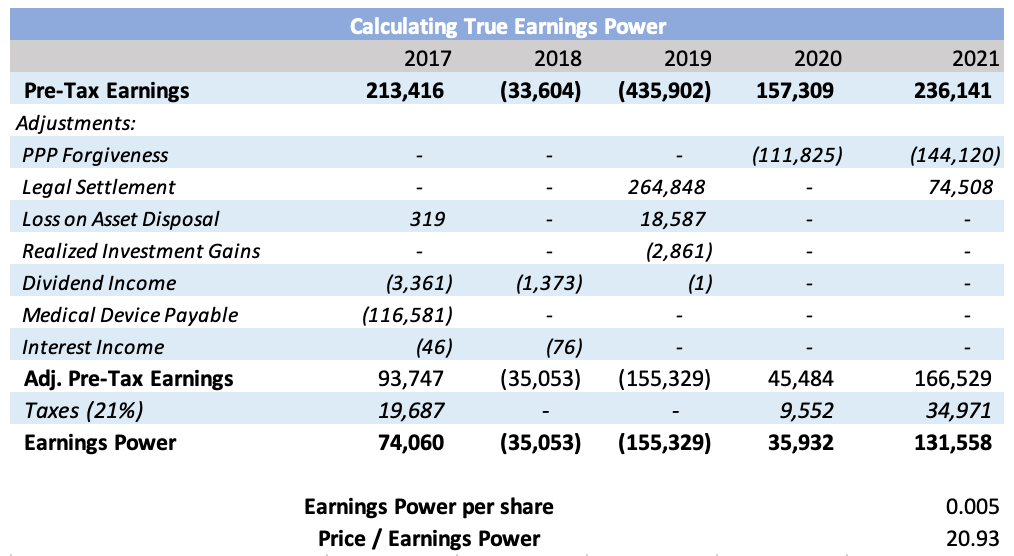

I mentioned before that KLYG’s earnings are misleading for the last two years, with profits higher than true economic earnings. To clear up accounting issues right now, here is how I have recalculated true earnings power for KLYG over the last five years:

Again, this table doesn’t really do KLYG any favors, 21x earnings is even less appealing than before. However, KLYG is far more than meets the eye, and I present the table only to show you what I believe the market thinks.

Variant Perspective

The biggest factor that the market is missing is growth. KLYG is in the final stages of a remarkably successful turnaround. As such growth hasn’t been the primary concern of management until much more recently. Still, they have done well, and with their biggest expenses and investments behind them, KLYG is about to reap the rewards of its immense operating leverage:

Remarkably, 2020 results are reflective of a year when nationwide surgical procedures declined heavily. Even so, KLYG’s revenues increased 15% (see summary statistics), and operating margins increased 2%. 2021 was a testament to the kind of success KLYG can have in a (more) normal year, with their operating leverage on fuller display. In the next decade, profit margins have the potential to hit 15%.

Even though KLYG has been in the midst of a turnaround, capital expenditures have been relatively light:

Average CAPEX ($37k) & average Depreciation + Amortization ($27k) over the last 5 years has been only around $32k. Simply put, this isn’t a business that requires a lot of investment.

Sales should easily be over $3m next year and margins will continue to grow. Here is a look at just how cheap KYLG is based on my projected earnings for next year: (In truth sales should be higher, still 9-10x P/E seems right)

In short, you are getting a growing & capital light business for 9-10x 2022 earnings.

In the longer run (Variant Perspective)

The cranioplasty industry incredibly niche, and there are not many other players. KLYG is recognized as a leader in the design and manufacturing of custom cranial implants. A report on the Cranial Implants market by Market Data Center listed only 10 companies operating in the space (including KYLG). With only 5 of those companies (including KYLG) based domestically. Additionally, the report expects the market to grow at a CAGR of 11.2% reaching $2.48b by 2030. I found research published in 2018 by Transparency Market Research that predicted a CAGR of 6.8%. Lastly a report by DelveInsight published this year, stated the global cranial imlant market is $1.09b in 2021, and will grow at a CAGR of 6.07%, until 2027 when the market will be worth $1.55b.

In an interview with HartfordBusiness, KYLG’s CEO stated the company owns around 2% of the current U.S. cranial implant market, and hope to double their market share in the longer term. According to company filings, KLYG has already doubled market share before, as they only had 1% market share 5 years ago.

I am not going to spend thousands of $s on any of these reports so my math may be a little bit off, particularly regarding how big the USA’s share of the market is… but based on DelveInsight’s report I have calculated the following:

Creating a DCF based on these numbers, my expectations for margins, interest expense, etc, finds this stock to be incredibly underpriced:

The upside looks really attractive, but I recommend you keep reading for the full story on KLYG. I have abbreviated a lot of things up to this point to make my stance on the company more clear and the pitch effective.

Catalyst

Unfortunately there is no catalyst that I can identify, so the CAGR of one’s investment return will likely be overly reliant on KLYG posting higher earnings. A sale is possible, particularly at KLYG’s size, but I have no reason to expect that one is imminent.

Why Is This Oppurtunity Avaliable?

To find the true economic earnings of any entity, one needs access to financial statements, earnings calls, etc. Unfortunately, KLYG hasn’t made this easy.

Prior to this year, KLYG was not current in its financial reporting, only issuing annual & semi-annual reports. Although they are now current, past financial reports are incredibly difficult to track down for certain years. Additionaly, KLYG’s financial statements are some of the more complex I have ever read. They are easy to read one at a time, but the way certain items are classified is inconsistent with prior years, and until this year, there weren’t any notes sections to help. As a result, the market has big concerns over the validity of KLYG’s financial statements, and its ability to stay current in reporting. Which given the size of the company isn’t unreasonable. Additionaly there is not a lot of research available (for free) about the niche cranial implant industry. If one only looks at historical results, its hard to find any reason for lots of optimism.

Previous management was awful. I’ve already mentioned the lack of financial reporting, but in truth the issues went deeper than that. Management basically destroyed what was a profitable and well run organization. The market seems to not trust current management’s ability to stay away from this happening again.

Lastly, this is $2.6m company. Very few institutional investors can invest in a company of this size, even fewer are willing to. About 20% of the company is held by insiders (this is higher than historically), and the rest is likely traded by retail investors plus maybe a few institutional investors. Without any analyst coverage, there is not a lot of information on this company, unless you are willing to do the research yourself.

The Turnaround

The current CEO, Ross Bjella has helped KLYG take strides in becoming more shareholder friendly. In 2011, Bjella was actually a consultant working with KLYG and helped them receive approval for their first 510(k) (FDA clearance). In fact Bjella claimed he and another employee were hanging drywall when they learned of the approval.

Results were good in the first year or so after the work was completed. At one point, right before Bjella left, the stock even hit $1.00/share (around $0.10 right now). However, after his departure KLYG started disappointing and the company failed to grow as expected. From 2012 to 2016 the average growth rate was -15%. Things all came raining down in early 2017 when KLYG received a warning letter from the FDA after an audit found deficiencies in some of the documentation around a line extension and in some internal reporting controls. Sadly, the line extension in question made up > 25% of KLYG’s previous year sales. At this time in mid 2017, Bjella rejoined the company in a consulting role, but by the end of the year, he was KLYG’s Chairman and CEO. During the first year under Bjella, KLYG voluntarily stopped manufacturing the product line in question, added key personnel, and started working on a turnaround plan.

By the end of 2017, KLYG posted revenues of $1.8m, which was the highest since 2013 - the year sales previously peaked. Gross profits also increased 37%, as the company managed costs better. Bjella’s insistence of improving relationships with partners and adding new ones, was already paying off.

In early 2018 Bjella and co. designed a 5-year plan centered on the following 5 strategies

Improve sales & marketing efforts

Increase the # of representatives selling KLYG implants

Provide outstanding service to the surgeons who choose KLYG products

Ensure compliance with regulations & consistently produce the highest quality products on the market

Expand the product line & build a pipeline of future product oppurtunities

They were ambitious but KLYG had little cash to work with. The company was in poor shape because of how bad prior management was. Some employees/executives took pay cuts & delayed compensation, and the manufacturing team worked day and night, even flying out to customers to deliver implants by hand. A new program was created, to increase recruiting of representatives. And KLYG’s Cheif Operatign Officer (happens to be the employee Bjella was hanging drywall with in 2011) created a new product development strategy. In only the first year of the plan, sales increased 15% to over $2m, and the number of representatives increased by 38%.

Today

2021 marks the 4th year of the original 5-year plan, and In February, KLYG announced 2021 results. They were very impressive, operating income was $180k a 363% increase from 2020, Net Income was $202k an increase of 43% from 2020, and revenues were $2.6m, up 6% compared to 2020. 2021 also marked the 5th consecutive year of sales growth. During the year, in addition to becoming current in their reportings, KLYG also:

Signed a strategic distribution agreement with “Fin-ceramica faenza Spa” to market their Cranial Implant in the U.S.A.

Received a patent on their Integrated Fixation Systems designs, their flagship product.

Regarding 2021 results, Bjella said:

“Despite Covid 2.0 shutdowns during the 1st quarter of 2021 and the Omicron variant shutdowns in the 4th quarter, Kelyniam achieved record operating profitability during 2021. This performance in the fourth year of our five-year plan confirms the company’s ability to meet long and short term goals. Our objectives in 2022 are to accelerate profit and sales growth through our partnership with Fin-ceramica and the development and launch of organically-created complementary products.”

Bjella looks like a capable operator. He has hit all of his goals so far, and I see no reason for this stop now.

Debt isn’t insignificant, but I believe it is overstated due to “officer loans” which involve litigation issues the company had with previous management. These will be paid down entirely by 2023. There is no cash listed on the balance sheet, and totals have been low for a while. This is due to the previously mentioned investments and expenses that KLYG has had to rack up in recent years. However, with KLYG having so much operating leverage, cash should start to pile up soon, as the company reaps the rewards of its investments. Now that they are profitable, I also don’t expect the company will issue any more equity to access cash. Their new credit agreement backs this up. As cash flow finally starts to run, I believe the stock price will too. Still, no matter how you look at it, KLYG is a fairly speculative investment, and there are lots of risks. But I believe the risk/reward profile is appealing.

As always thank you for reading! None of this is investment advice and you should always conduct your own due diligence. I own shares of KLYG.