Tax-Free Spin-Off: LGL Group, Inc. (LGL)

Special Situation - potential for massive annualized gains

My experience in analyzing potential spin-offs is nascent, or more accurately in far less fancy terms - non existent. Nonetheless while conducting this research I became captivated by the potential of these“special situations”. What’s not to like about clear catalysts and potential for big gains in a short periods of time? Anyway, I hope to write about more of these in the future, and of increasing complexity. But for the time being, I hope you enjoy this stab at a relatively straightforward tax-free spin-off. I just finished exams so write-up output should be more consistent in the future.

Executive Summary

The LGL Group, Inc. (LGL), is a manufacturer of electronic components and instruments. The company operates through its two subsidiaries - M-tron Industries, Inc., (“MtronPTI”) & Precise Time and Frequency, LLC (“PTF”). MtronPTI is the electronic components business, while PTF deals in electronic instruments…

MtronPTI designs and manufactures high-reliability frequency and spectrum control products. These components are used in electronic systems for applications in the military, aerospace, medical, and telecom industries (among others). Without getting into the nitty-gritty, the image below may clear up potential confusion:

(Image from LGL’s 2018 Investor Presentation)

The other subsidiary, PTF, designs and manufactures time and frequency products for various industries including the computer networking, electronic utilities, and telecom industries. Again, see the image below for some examples.

(From PTF’s website)

PTF is the newer of the two operations but MtronPTI is by far the biggest and most important:

In October, LGL’s Board of Directors approved a spin-off of MtronPTI to shareholders, in a tax-free distribution. In otherwords, LGL shareholders will recieve shares of the new independent Mtron business, while also retaining stock in LGL. The specifics regarding how many shares of Mtron shareholders will recieve for each share of LGL is not yet disclosed. According to an 8k LGL filed with the SEC late last month, shareholders will vote to approve the spin-off at 9:00 am (ET) on Tuesday, June 21, 2022. The Board established that the record date for determination of stockholders who are entitled to vote will be the close of business on May 6 (in two days). This just means you only get to vote if you own shares before the market closes on Friday. The spin-off is expected to close no earlier than the 2nd quarter of 2022. LGL will not retain any interest in MtronPTI after the spin-off but will remain 100% owners of their PTF subsidiary and practically all of its cash/securities. LGL believes that MtronPTI will be worth more as an independent company, and separating the businesses will allow investors to better gauge the developments and progress of the business.

There is a high likelyhood that the transaction closes, as LGL has successfully spun off multiple businesses in the past. Some might also find it interesting that LGL’s non-executive chairman is Marc Gabelli, who is the famous Mario Gabelli’s son. Mario and Marc hold a large portion of LGL’s stock, but it is very important to note that only about half of Mario’s stock is directly owned, the rest is owned by GAMCO, GGCP, and his foundation. Additionaly the majority of Marc’s holdings are through Venator Merchant Fund L.P., though their only general partner is Venator Global, which Marc is the president and sole partner of. (Information on holdings is from LGL’s 10k)

Summary Statistics

As you can likely infer, everything in the 2021 column below “operating profit margin” is significantly overstated. This is due to accounting rules that include unrealized gains/losses on investments in income figures. Still, the top line numbers give you a good idea on how LGL fared over the last 5 years. Like many firms, they were hammered by the Pandemic and real earnings in 2021 are negative. According to GAAP though, LGL had a record year, making $2.75 EPS and the stock now sells at only 4x earnings. Of the unrealized gains/losses impacting earnings, the majority are from an investment in a SPAC sponsor, which made a succesful business combination. As shown below, adjusting earnings for the SPAC transactions makes a huge difference:

(From 10-k)

Although the investment heavily distorted GAAP earings, it also generated a ton of cash for LGL, as they sold their shares that weren’t subject to lockup agreements. However, they still hold a considerable amount of restricted shares that can’t be sold yet. Unfortunately, share prices have plummeted ever since the business combination. Thus, when LGL is finally able to liquidate their position, it will surely be for less than the value booked in the 10k. The implications this has on our analysis will be discussed in a bit - for now though here are the cash & securities totals:

Thats $45m total! Even if all the securities are worthless, you are looking at a company with cash worth more than half its market cap.

Variant Perspective

The price LGL sells for in the market is well below the combined value of the soon-to-be independent Mtron subsidiary and LGL’s cash/non restricted securities, net debt.

I wholeheartedly agree with management’s decision to spin off MtronPTI. It’s clear that the market doesn’t appreciate how valuable Mtron will be as an independent operation. Becuase of LGL’s pursuits of other opportunities and strategies, they have racked up a decent amount of annual general corporate expenses, diluting and hiding the true profitability of Mtron. The magnitude of these expenses is surprisingly large. For a visual look see the table below:

As you can see, in certain years Mtron was > 2x more profitable than LGL, and in all but one year, Mtron’s margins were at least 50%+ greater!

Given that Mtron makes up the majority of LGL’s revenue, it shouldn’t come as a surprise to learn they were severely hurt by the Pandemic: (table above shows this too)

Most concerning to me is that 2021 was another year of declining sales. However, 2022 looks like it will be the turnaround year. Order backlog going into 2022 is $30m, 50% more than the $20m LGL had going into 2021. (To be clear that is for LGL as a whole, though most of it’s attributable to Mtron)

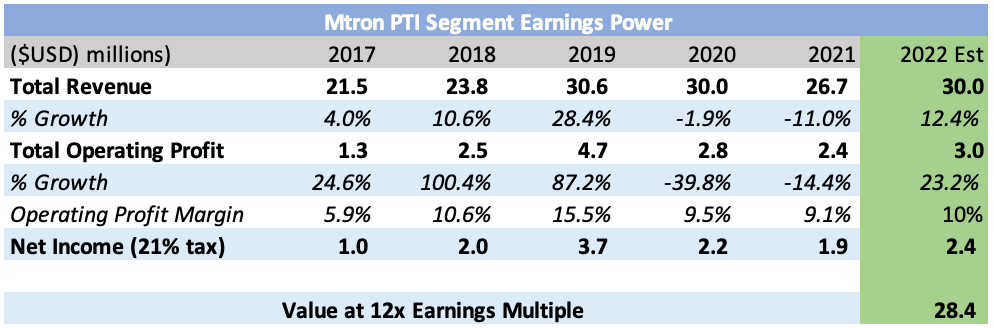

Revenues for Mtron in 2022 should be over $30m, and assuming they can return to pre-pandemic margins, a 10% operating margin is reasonable. With 21% taxes, and only marginal debt, earnings should be ~$2.4m in 2022. Of course, there will be some new expenses that come with being an independent, SEC reporting company. Additionaly there may be one-time costs associated with the spin-off. Thus, one shouldn’t be surprised if reported numbers are lower. However, the benefits of being free from LGL’s overhead should far outweigh the cost’s of independence.

We obviously don’t have the information to calculate ROE, but LGL does list the assets attributable to Mtron ($15.9m) which assuming my earnings estimates are correct = 15% ROA. That is an unrealisticly high return, and the demoninator will surely be much higher, though it’s still interesting. LGL also lists CAPEX for Mtron which has been very low over the last two years (1.49m total, 1.1m in 2021), in 2021 their capex/sales ratio was only 4%. Using the asset and capex information, my rough approximation of return on capital in 2021 is around 11%. But that is at the low end of what they should earn. Regardless of all of this, we want to be conservative, and in recent history Mtron hasn’t been a very fast-growing business - even in good economic periods. As such, 12x earnings is a conservative and reasonable multiple to assign the company. At 12x 2022 earnings, Mtron is valued at $28.4m:

In addition to Mtron, LGL has the other operating business (PTF) and about $45.2m in cash and marketable securities. PTF is profitable but it does’t contribute a lot and the business is tiny right now, so for the sake of extra conservatism, I am not assigning any value to it.

On a side note, one of my professors marked off points for my valuation project becuase “the assumptions were too conservative”…Not a Ben Graham fan I suppose? Anyway, back to the analysis…

Of LGL’s $45.2m of cash & securities, $29m is in cash, and $16.2m is marketable securities. This is a little bit repetitive but just to recap the cash/securities situation: Much of this cash was generated by the previously mentioned investment in a SPAC sponsor. The business combination they completed was with IronNet Cybersecurity, Inc. (IRNT), and as a result, LGL received millions of shares and warrants. Like many SPACs/De-SPACs, IRNT isn’t a good investment. As a result, LGL’s holdings of IRNT have plummeted in value since receiving shares. For the record - I know nothing about IRNT’s business model, I am just commenting on the financial results and stock performance:

Screenshots from Tikr

Screenshots from Tikr.com

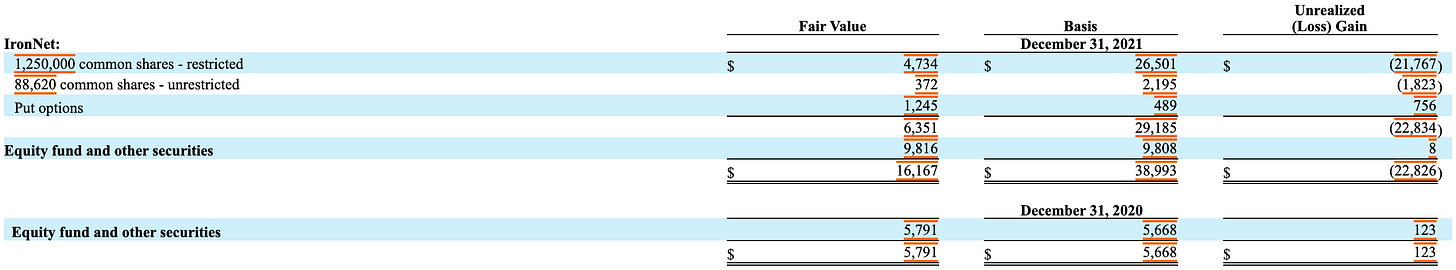

As of the most recent 10k, LGL sold almost all of their unrestricted IRNT stock, generating proceeds of $18.5m towards the cash totals. They also donated $1.3m of IRNT stock, which should show you how worthless these shares really are. As a hedge, LGL also has a lot of put options. To be exact, here’s a breakdown of what comprises the $16.2m of marketable securities:

(From 10-k)

As you can see, about $6.4m of marketable securities are in one way or another related to IRNT. Astonishingly, LGL’s unrealized loss on these holdings is over $22m as indicated in the table. Considering everything we’ve just gone over, it would be foolish to take the $6.4m at face value, unless of course you’re in the finance department at AU ;) … To be conservative, I calculated a reasonable estimate of the likely cash value for the IGNT stock by adding the value of “unrestricted shares” to the value of “put options” (= $1.62m) (to account for any salvaging of the “restricted shares” I rounded up to $2m). My reasoning is fairly simple, I think it is more likely than not that LGL has already liquidated the remainder of their unrestricted IGNT shares. Additionaly the put options are the hedge, and more likely than not, they are understated in value. Thus rounding up to $2m could account for some of that. The $9.82 of “Equity fund and other securities” seems to be stable, and after reading the notes it appears this is money invested by Gabelli or one of his funds, so I feel comftorable taking that number at face value. Thus my conservative estimate of the cash value of marketable securities is $11.82m:

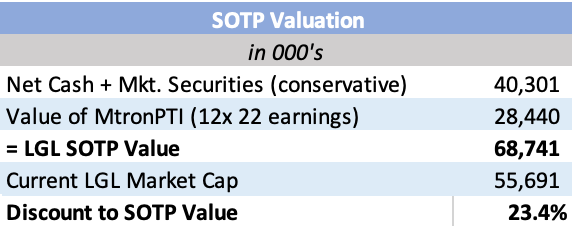

As such, total adj. cash and equivalents are around $40.4m ($11.4m + $29m in cash). LGL only has around $500k of debt - so net cash is ~ $40.3m:

Previously, we valued Mtron at $28.4. To calculate the value of LGL at the sum of its parts (SOTP), we add this to the net cash & securities. The calculation reveals LGL is trading at a nearly 1/4th discount to its SOTP value! This is shown in the table below:

Catalyst

Part of what attracts me to special situations so much is that the catalyst is obvious and relatively predictable. We know the spin-off will be voted on in June and I think its very likely to be approved (though I have no proof to back this up). According to S&P Capital IQ the spin-off is expected to close in the 2nd quarter, but one suspects this is based on the earliest possible date as indicated by management. While completely speculative, there is no reason the distribution shouldn’t close before the 3rd quarter ends.

It is probably not responsible to assume this situation will actually return 23%, but as long as the return is somewhat close, and the spin off closes before the end of 2022, the annualized returns enjoyed by the investor will be substantial.

Why Does This Situation Exist

Becuase there is no analyst or even “fintwit” coverage of LGL (that I have found), it isn’t exactly clear what the bear case is. However, the most plausible and reasonable case is that the market is waiting to see how well the Mtron segment does in the first two quarters. If Mtron cannot make progress towards getting back to pre-pandemic levels, my thesis will be significantly impaired, or even obliterated, if the results are bad enough.

Of course as with any potential spin-off, the market may just be doubtful about it getting approved by shareholders. My research hasn’t yielded any good reasons to support this view, but the market isn’t always rational. Additionaly the usual small company concerns are prevalent: too small for many institutional investors, illiquidity concerns, etc. The real reason the opportunity exists is probably for some combination of all these reasons.

I don’t have any experience closely observing the way investors react to each stage of the process. Presumably, once (if) the shareholders vote to approve the spin-off, the market will gain more confidence, and shares will adjust accordingly. Though given the previously mentioned small company concerns & those regarding the first 2Q results for Mtron, the gap in intrinsic value vs market value will likely remain at least somewhat wide until the distribution occurs. Lastly, it is hard to know how sophisticated LGL’s shareholders are (obviously exluding the Gabelli’s and related funds), if enough retail investors dump their distributions, an opportunity to buy Mtron shares at an attractive valuation might exist. Perhaps at even cheaper levels then currently available.

As always thank you for reading and let me know what you think! None of this is investment advice. There are many risks involved when investing in “special situations”, particularly in small and less liquid shares. You should always do your own due diligence.