Unit Corporation (UNTC) - Asymmetric Trade

An attractive opportunity in this volatile market

Hi Everyone! I’m currently working on a write-up for another firm that I hope will be done soon. Since the market has been falling lately, I’ve spent a lot of time analyzing multiple companies and making purchases. Thus, I have not spent enough time writing. I didn’t want to rush my write-up, but I think a post is necessary this week as I don’t want readers to think I am scared out of the market/etc. While it is my opinion that many companies are still trading at absurd valuations, there is value to be found overall. This is a short analysis and not a full pitch, but I think it is interesting nonetheless.

(2022 Q1 results were posted last night, but I did not incorporate these results as I didn’t want to delay the post this morning - Regardless, my thesis remains intact)

Unit Corporation (UNTC), is an oil and gas producer trading on the pink sheets. The company has three main segments: upstream production, contract drilling, and a midstream division. Unit was one of the many e&p companies to enter bankruptcy in 2020. However, unlike most of the others, Unit successfully reorganized without the creditors taking control. Unit emerged from bankruptcy with a new management team, focused on financial discipline and cutting costs. Management has already proven its prowess financially, selling assets and its headquarters to pay down all of Unit’s bank loans. Additionally, Unit has repurchased a large number of its shares. Here is a stock chart and some statistics:

(From Yahoo Finance)

As you can see on the stock chart, 2021-22 has been kind to Unit. Some of this can be attributed to the debt repayments, asset sales, and buybacks, but the biggest contributor to Unit’s success has without a doubt been the rapid increase of commodity prices. For an example, here is a chart of oil futures:

(From WTRG Economics)

To capitalize on these high valuations, Unit announced its intentions to sell up to all of its upstream oil and gas properties and reserves. According to Reuters, anonymous sources claimed the sales could go for $1b. A substantial price for a company with a market cap of only ~ $580m. Furthermore, the catalyst seems imminent, as Unit anticipates any sales will close in the 2nd quarter. If you believe the rumored potential value is realistic, Unit looks ridiculously undervalued on just their upstream segment alone.

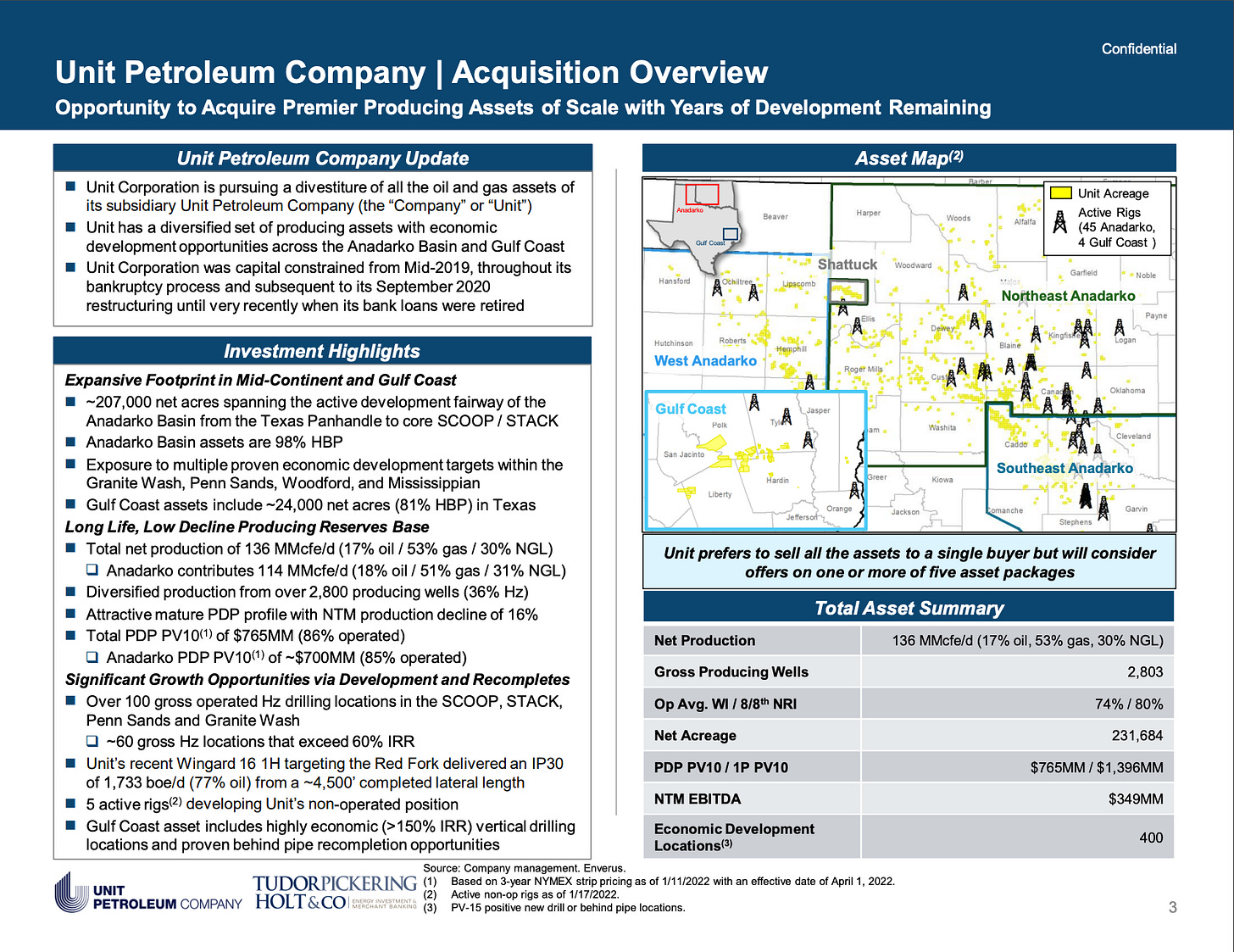

Upon request, investor relations sends out a presentation regarding the potential sale. The material is from the winter, when oil and gas prices were lower, but it gives us more information about these assets. The material was put together by an investment bank Unit hired for the selling process:

In the section labeled “Total Asset Summary”, we see the net production, net acreage, and estimated EBITDA, among other things. The most important information in this section is the “PDP PV10/1P PV 10”. If you are unfamiliar with these terms (as I was):

PDP = present value of proven producing o&g reserves

1P = PDP + reserves that are likely to be recovered but not yet proven

PV10 = discount rate in the PV calculation is 10%.

We can see the investment bank has calculated PDP at $765m, and 1P at $1.4b. I imagine this is what the anonymous sources used to come up with that $1b number. Given all of this, I think the $1b number is surprisingly reasonable. If this situation hasn’t intrigued you yet, consider this, Unit has almost $400m of NOL’s. In other words, the taxes Unit would pay on any sale are likely to be substantially smaller than they would be otherwise.

But what if a sale doesn’t materialize? Well, unless Unit can sell these assets for a good price, shareholders may actually be better off without a sale (assuming commodity prices stay high). Unit produced robust results this year despite being heavily hedged, meaning they didn’t even have to rely on the high commodity prices to generate returns (Unit was forced to hedge against potential commodity weakness coming out of bankruptcy). Pre-tax income attributable to the upstream segment was $164.4m, up from -$9.4m last year. Furthermore, total net income from Unit as a whole was $60.6m this year (EPS $5.3) compared to -$18.1m (EPS -$1.51) last year. The company is already cheap based on these earnings (~ 10.5 P/E), and assuming commodity prices remain strong, results this year will be even better.

Needless to say, as long as Unit doesn’t take a low bid for its assets, shareholders will do well regardless of if any asset sales happen. Hence why I believe this opportunity offers asymmetric returns. I estimate intrinsic value is around $70/share at minimum, based on the conservative PDP number adjusted for some potential tax considerations. Again, the PDP is just for the upstream segment, so I think it’s a reasonable estimation.

As always thank you for reading! None of this is investment advice and you should always conduct your own due diligence.

Dear William,

I hope this message finds you well. I'm keen to discuss some ideas about Unit with you. What's the best way or platform for us to connect?

Best regards,

David